Since January 2020, the Individual Coverage HRA has continued to gain traction among business owners looking for personalized, budget-friendly, and predictable benefits solutions. As an HRA administrator, Take Command has analyzed our current roster of clients using this reimbursement model. From this data, we've been able to draw insights and trends helpful for other business owners considering an HRA.

What this report will cover:

- ICHRA overview

- ICHRA at a glance

- A look at reimbursement rates

- How employers are using ICHRA classes

- Top locations for ICHRA

- Top industries for ICHRA

- How employees are responding

- Upgrading from QSEHRA to ICHRA

- ICHRA and Coronavirus

- What we hope to see in the future

- What's new at Take Command Health

- Additional Resources

ICHRA Report

ICHRA 2020 Overview

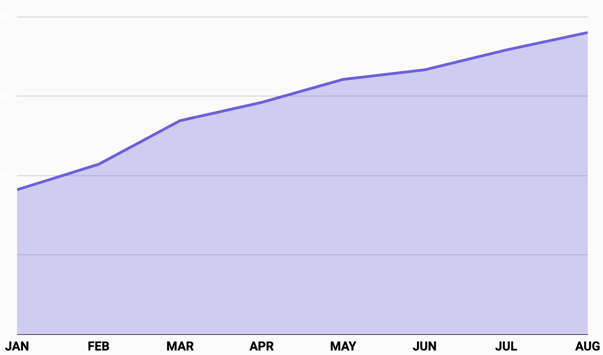

HRA signups at Take Command have more than doubled since our initial findings on ICHRA pioneers at the beginning of the year, and it’s certainly trending upward now with benefits season here. In fact, there are bold indicators pointing toward stabilizing individual markets (a critical factor in the success of ICHRA), like the MLRs (Medical Loss Ratios) of carriers in the individual market and the rebates being provided to policy holders.

We’ve seen consistent monthly signups with a notable exception. As expected, we saw a downturn of new ICHRA signups for the month of March. Instead of affecting March’s signup numbers, however, what that actually means is that because of the 90-day employee notice, our numbers fell for June as employers kept a watchful eye on market conditions. Numbers have picked back up swiftly.

→ Check out our post on ICHRA 2025 for the latest information!

→ Wondering which health insurance carriers are best suited for ICHRA? We've got a report for that.

Ready to save on benefits cost?

ICHRA signups per month at Take Command

source: Take Command

ICHRA 2020 at a glance

Here are a few big takeaways from our ICHRA 2020 analysis.

- Client size: Clients ranged in size from 1-151 eligible employees

- HRA design: Percentage of employers reimbursing for medical expenses and premiums: 60%; Premiums only: 40%

- Varying rates: Most employers chose not to vary by age but only family status.

- Upgrading to ICHRA: 46 of our existing clients that previously offered a Qualified Small Employer HRA switched over to offering an ICHRA so they could offer more benefits to their employees. (QSEHRAs have a cap, ICHRAs do not).

- ICHRA location: California, Texas, Florida, Pennsylvania, and New York lead the country in terms of ICHRA signups, thanks to their strong individual markets. Colorado, Minnesota, and Massachusetts are also notable front-runners. We now have clients in 44 out of 50 states.

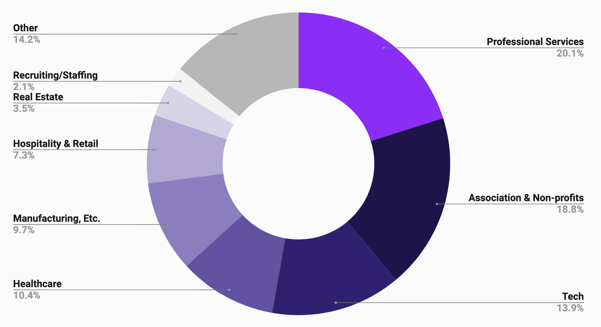

- Common industries: Four leading industries include: professional services (legal, financial, insurance, marketing, consulting), non-profits / churches / associations, tech companies, and healthcare providers and services.

- ICHRA participation: Overall 58% of employees participate in their ICHRA benefit. This is in line with the national average of employees (61% in 2019) that take up coverage from their employer’s group benefit according to a study by Kaiser Family Foundation. Remember: there are rules on what type of coverage integrates with ICHRA (like no spouse’s plans or sharing ministries).

Key findings for ICHRA 2020

How much are companies reimbursing with ICHRA?

The average reimbursement rate for 2020 ICHRAs are $749.93 for singles, $847.20 for couples, and $931.95 for families.

There were outliers that we excluded from the overall average that are worth pointing out as they demonstrate how customizable an ICHRA can be for each company and their budget. The minimum reimbursement was $40 a month and the maximum was $20,000 pepm.

Ask us about ICHRA design ideas for your company!

Are companies using ICHRA classes to streamline benefits?

The quick answer is yes! One of the major selling points of the individual coverage HRA is the ability to scale benefits across different types of employees, allocating specific amounts for different classes of employees, like part-time vs. full-time, or salary vs. hourly.

Out of our clients, the number of classes used ranges greatly. One employer designated 12 classes, representing the largest number of segmentation. Employers generally have between 1-5 classes. Average plan has two classes. 26% of classes include geographic areas, representing employees outside the geographic region of headquarters (i.e., remote workers.

Trend forecasting: Where is ICHRA taking off?

States that have the most HRA enrollments so far are CA, FL, NY, PA, and TX, representing the states adopting this reimbursement style of insurance the fastest.

As more and more employers and their brokers hear about ICHRA, we expect to see ICHRA gain traction in areas with strong individual markets.

Here's a ranking of the top 20 states where ICHRA adoption is highest, based on client signups at Take Command.

- California

- Florida

- Texas

- New York

- Pennsylvania

- Oregon

- Colorado

- North Carolina

- Massachusetts

- Washington

- Maryland

- Georgia

- Indiana

- Washington D.C.

- Minnesota

- New Jersey

- Ohio

- Utah

- Illinois

- Michigan

Ask us how your local insurance market works for ICHRA!

Top industries to offer ICHRA

While we have clients in almost every sector, certain types of industries and businesses are more likely to offer an ICHRA to their employees. Here's how the list breaks down.

source: Take Command

Are employees catching on to the ICHRA trend?

Our findings conclude that employees are signing up to participate in their employers' HRAs.

Overall, 58% of eligible employees participated in their ICHRA benefit. This is in line with the national average of employees (61% in 2019) that take up coverage from their employer’s group benefit according to a study by Kaiser Family Foundation.

It's important to note the participation requirements for ICHRA. Eligible employees must secure individual insurance coverage (either on/off exchange or Medicare) to participate. Employees that have insurance secured through a spouse’s employer cannot participate in ICHRA. In this way, the ICHRA plan most closely resembles a typical employer sponsored group plan.

Clients are "upgrading" from a Qualified Small Employer HRA to an Individual Coverage HRA to offer more generous benefits

While the Qualified Small Employer HRA is a great option for many, some companies felt limited by the QSEHRA reimbursement limit that's placed on it. With that in mind, we weren't surprised to see a portion of our existing clients move over from offering Qualified Small Employer HRAs to offering the limit-less Individual Coverage HRA.

The QSEHRA limits for 2020 were $437.50 for single employees and $883.33 for employees with dependents. From our clients that converted to ICHRA, we saw the average monthly allowance overall rise to $1,860 a month with most employers choosing not to vary rates by age and stick to the contribution model of QSEHRA of varying rates by family status. The average allowance for single employees increased to $761.46/ month and $929.99/ month for employees with dependents. The average company size in this category had 4 employees with 2 participating in ICHRA.

ICHRA and Coronavirus

On a highly relevant note, watching the flexibility inherent in HRAs play out in real life during the pandemic has been interesting. Many of our clients were able to maintain benefits because they could make adjustments on the HRA front.

A few notable examples:

- Limiting reimbursements to premiums only

- Asking employees for increased flexibility by holding off making claims if they can (monthly allowances accrue for later use in the year) and honor reimbursements that employees can’t afford

- Modifying plans to extend benefits to employees otherwise ineligible for group coverage

- Adjusting plan requirements, such as the minimum number of hours threshold, so that employees that have had a reduction in hours can still qualify for employer reimbursements

See our blog post about this here.

What comes next

While there are changes we hope to see from a regulatory rule perspective, we believe the bipartisan nature of HRAs will serve them well in the coming months and years.

Here are a few regulatory actions we hope to see:

- Reduce the length of the 90-day notice period

- Clarify employers’ responsibility with respect to the employer responsibility provisions

- Minimize administrative burden of offering ICHRAs by finalizing the safe harbors proposed in the rule and offering new flexibilities.

To see our letter, with the support of several benefits industry leaders, sent to Commission Rettig and Secretary Mnuchin on this matter, click here.

What's different this year at Take Command

Much of our time and investment has been building products and teams to support the increase demand for ICHRA and to engage and educate brokers. In anticipation of a major uptick in HRA signups, we’ve redone our website from an experience standpoint, have hired a dedicated enrollment team to help employees find HRA-compliant plans, and have launched a broker partner program to help educate and empower the front line.

Other helpful resources

- ICHRA Guide

- ICHRA FAQs

- Article: Early Adopters of ICHRA

- ICHRA Affordability Calculator

- 2019 QSEHRA Report

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!