The health of the individual health insurance market is a cornerstone of the ICHRA model and an integral part of fixing our cost-burdened healthcare system. Employees offered an ICHRA need an abundance of quality, affordable health insurance options to choose from as they assess the needs of their family. The marketplace or federal exchange, created by the ACA, has overcome its initial shortcomings and is as strong as ever. Carriers continue to expand their footprints, premium pricing is stable, and most importantly, more and more people are enrolling.

Affordable Care Act Introduces Change to the Individual Health Insurance Market

As I’m sure you can remember, the ACA brought widespread change to the individual market upon implementation in 2014. It introduced important consumer protections such as:

- Guaranteed issue & no medical underwriting (aka “community rating”)

- ACA-compliant plans must cover all Essential Health Benefits

- Coverage for all pre-existing conditions and free preventative care

This means, for all available individual plans, on or off-exchange, provide compliant coverage and protection for individuals. Healthy to the unhealthy, individuals do not take on their own risk as premiums are set based on age.

A Strengthening Market: Carrier Expansion & Stabilization

The early years of the ACA (2014-2017) saw an uneven and often bumpy market evolution. Now, markets have stabilized with carriers re-entering and premiums flat or decreasing in many regions.

Many carriers now offer $0 telemedicine, $0 generic drugs, wellness perks and built in dental and vision.

2021 brought additional carrier expansion with:

- 30 insurance carriers entered new states (Aetna CVS Health, Bright Health, Moda, and UnitedHealthcare join the Texas exchange for 2022)

- 61 insurers expanded service areas

- Now, there’s an average of 5 insurers per state

- Premiums have stabilized (along with MLRs)

- State-level reinsurance programs have lowered premiums (ie: Georgia, Alaska, and Ohio)

This past year, More than 1.5 million people selected a 2021 health plan through the special enrollment period created in response to COVID-19, with an additional 600,000 enrolling through the 15 state-based marketplaces, the Department of Health and Human Services reported last month.

As the risk pool continues to grow, it further stabilizes the market.

PetersonKFF Health System Tracker reported 13 states plus the District of Columbia with only slight increases this past year, with a median increase of 3.8% for individual health insurance plans.

Most insurers noted little to no impact of COVID on their rates. Reinsurance programs, state-based public options, and the premium tax credits extended through the American Rescue Plan Act are all contributing to more affordable healthcare. ICHRA, working alongside these other forces, is also adding more individual health insurance enrollees to the marketplace. Carrier competition has also stemmed from these efforts, further driving costs down and consumer-friendly features up.

Individual vs. group health insurance costs

You may be wondering… how does the individual market compare to group rates? I’m glad you asked! To see where individual rates win, we like to point to Vericred’s heat map.

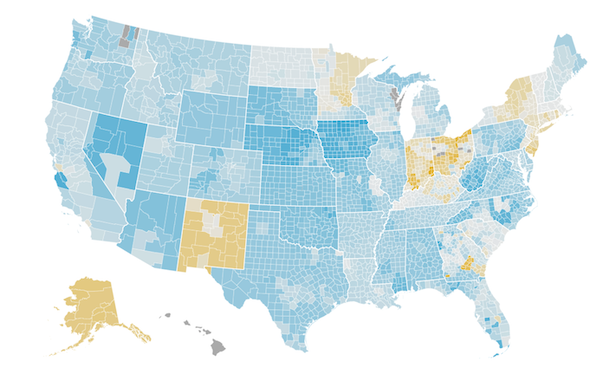

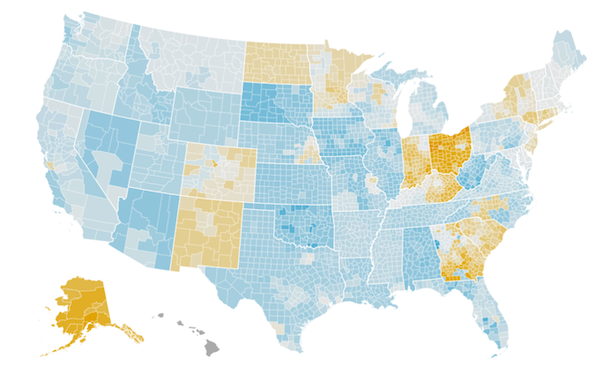

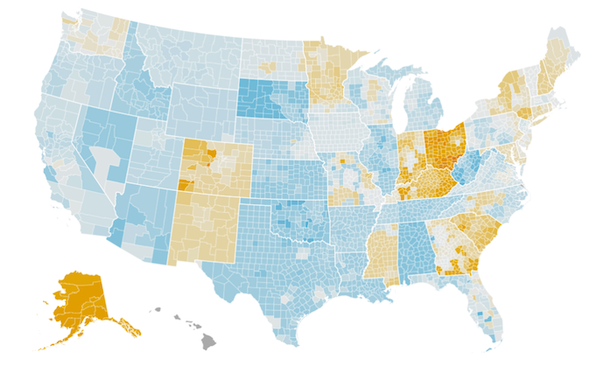

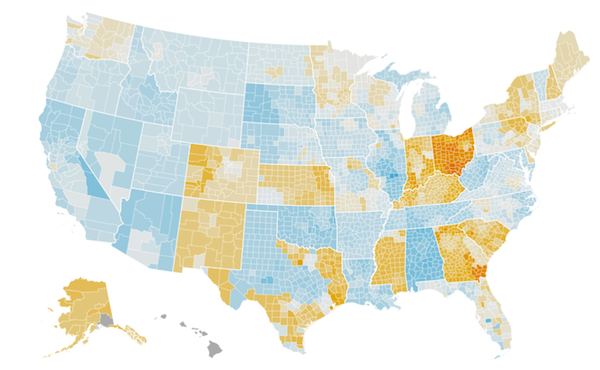

Below you’ll see the blue which represents a more affordable small group coverage (groups under 50 that are community rated) vs. yellow which represents a more favorable individual premium (of that of a 50 year old Bronze plan).

2019 individual vs group health insurance rates

2020 individual vs group health insurance rates

2021 individual vs group health insurance rates

2022 individual vs group health insurance rates (current)

Today, the individual premium rates win out in multiple states such as Colorado, Alaska, New Mexico, parts of Texas, Ohio, Georgia, New York, etc. in comparison to small group rates, meaning benefits spend stretches further with ICHRA.

Still, comparing group coverage to individual is like comparing apples to oranges.

There’s a few things that are different:

- The individual market provides few PPOs. In some states like Colorado and Texas, wide networks with out-of-network coverage are not an option.

- Hospital Networks

- Open Enrollment Period

What are individual insurance rates in my area?

Actual insurance companies and plan options can vary a lot by geography. To look into your local market, use our Window-Shopping Tool for plan options and quotes.

Is ICHRA a good fit for your client?

We’d be happy to see if ICHRA could be a fit for your client based on their local market. Reach out to brokers@takecommandhealth.com or submit a lead through our HRA Request Form.

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!