Looking for the best individual health insurance options in Los Angeles to use with an ICHRA? You're in the right place - and there's good news! The individual coverage HRA (ICHRA for short) is taking off where you live, thanks to a vibrant local individual health insurance market. That means more ACA-compliant, high quality health insurance choices for employees.

| We've put together this guide to help employees orient themselves to the local individual health insurance market in Los Angeles to use with their Individual Coverage HRA. Health insurance can be confusing, and many employees offered an ICHRA will be buying their own health insurance for the first time. We've got you covered! |

Who this guide is for:

- Employees shopping for health insurance to use with their ICHRA

- Employers wanting to help their employees make educated decisions about their health plans to use with their ICHRA

- Employers of any size considering implementing an ICHRA

What this guides covers:

- What is an ICHRA?

- Los Angeles individual insurance options

- Los Angeles insurance market snapshot

- Los Angeles health insurance carriers

- Cost of individual insurance in Los Angeles across carriers

- List of hospitals in network with carriers

What is an ICHRA?

First things first. An Individual Coverage HRA (ICHRA, for short) is a fundamentally new model of benefits that allows employers to set aside tax-free dollars to reimburse employees for health plan premiums that individuals choose themselves. That means employees get to choose the best plan for their family, their unique health needs, and their budget.

Los Angeles individual health insurance options for ICHRA

Individual coverage HRAs are taking off in L.A. thanks to the health, competition, and affordability of the individual health insurance market.

More and more employers in Los Angeles are realizing their benefits dollars stretch further on the individual health insurance market instead of group plans, and this brings ample employee benefits too, like personalization and choice.

Disclaimer: These rates are estimates for Los Angeles in 2021 in the 90011 zip code. Your premiums may vary and we expect slight changes for 2022. See our window shopping tool to check for exact premium rates in your area.

Market Snapshot

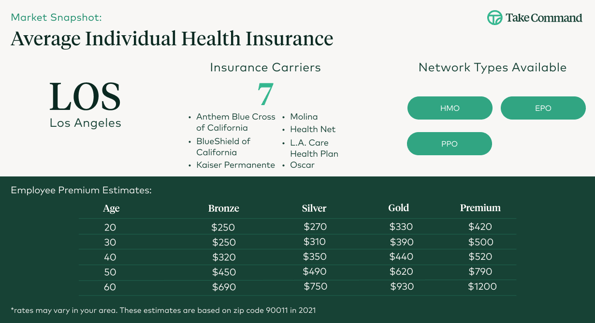

Los Angeles' competitive individual health insurance market and innovative carrier lineup mean more choices for employees. The infographic below demonstrates the wide range of carriers, network types, and average lowest cost premiums by tier.

Pro-tip: To calculate costs for adding a spouse or family to a plan, use double the rate for married, or triple for families.

L.A. has seven individual health insurance carriers to choose from and a wide range of network types.

Disclaimer: Plan information is based on 90011, the most populated zip code in Los Angeles. Rates will vary by zip code and county.

Remember, all of the plans listed here are ACA-compliant, meaning they cover pre-existing conditions and 10 essential benefits.

These benefits include coverage with no annual cap for the following:

- Ambulatory patient services (outpatient services)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services, including behavioral health treatment

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care

Have questions? Get in touch.Employees: If you are an employee looking to sign up for individual health insurance in Los Angeles to use with your ICHRA, our enrollment team is standing at the ready to help. You can set up a call with enrollment team here. Business owners: If you're a business owner and have questions about ICHRA, please click the green button below and we will get you scheduled with an expert. Brokers: If you're a broker considering ICHRA as an option for a client, submit an HRA Design request to see if this is a good fit for your client. |

The lineup: Los Angeles' best individual health insurance carriers to use with ICHRA

Los Angeles has a great group of individual health insurance carriers to choose from.

These include (in alphabetical order):

- Anthem Blue Cross of California

- BlueShield of California

- Kaiser Permanente

- L.A. Care Health Plan

- Molina

- Health Net

- Oscar

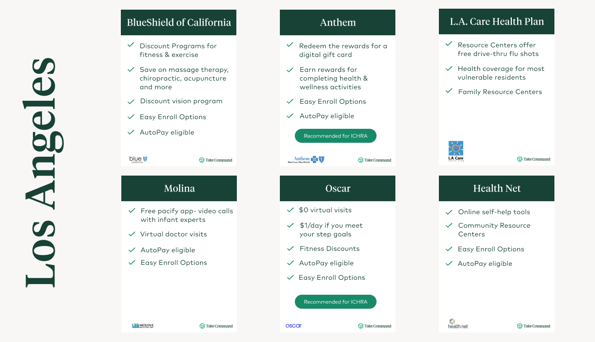

Here's a Los Angeles health insurance infographic for a quick visual.

| Anthem Blue Cross of California | BlueShield of California | Kaiser Permanente | L.A. Care Health Plan | Molina | Health Net | Oscar | |

| Recommended for ICHRA | ✔️ | ✔️ | ✔️ | ✔️ | |||

| Easy Enroll options | ✔️ | ✔️ | ✔️ | ✔️ | TBD | ||

| AutoPay eligible | ✔️ | ✔️ | ✔️ | ✔️ | TBD | ||

| Off-exchange options | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

*Autopay is a new feature on our platform that enables employers to take advantage of ICHRA and all its benefits without asking their employees to pay premiums out of pocket and wait for reimbursements.

One simple monthly payment that covers all of the reimbursements for insurance premiums (and medical expenses) for all employees. Our platform will manage the payments for employees' health benefits, reconciling their premiums and allowance with payroll. Learn more here.

*Easy Enroll is a plan feature that allows employees on the Take Command platform to enroll directly in the portal with no further steps needed. This is the simplest type of plan to choose.

*Off-exchange options are important for employees that choose a plan that costs more than their allowance, since they'll have to put in some of their own money to cover the difference. That difference can be tax-free when combined with a Section 125 payroll deduction but only for off-exchange plans (due to some ACA restrictions).

Here's another handy infographic that includes some of our favorite things about each individual health insurance carrier in LA.

How much does individual health insurance cost in Los Angeles per carrier?

Note: The below rates are 2021 estimates based on LA zip code 90011 only.

What we love:

- Anthem Skill for Alexa

- Smart Rewards program to earn points for health and wellness activities and redeem them for retail gift cards

- 24/7 Virtual care

- 24/7 Nurse line

- AutoPay eligible

- Easy Enroll options

- Recommended for ICHRA

Lowest cost by metal tier for Anthem in Los Angeles

| Age | Bronze | Silver | Gold | Platinum |

| 20 | $250 | $260 | $340 | $470 |

| 30 | $290 | $300 | $400 | $550 |

| 40 | $330 | $340 | $450 | $620 |

| 50 | $450 | $470 | $630 | $870 |

| 60 | $690 | $720 | $990 | $1,320 |

What we love:

- Discount programs for fitness and exercise

- Save on massage, chiropractic care, acupuncture, etc.

- Discount vision program

- AutoPay eligible

- Easy Enroll options

- Recommended for ICHRA

Lowest cost by metal tier for BlueShield of California in LA

|

Age |

Bronze | Silver | Gold | Platinum |

| 20 | $280 | $270 | $280 | $330 |

| 30 | $330 | $310 | $330 | $384 |

| 40 | $370 | $350 | $370 | $430 |

| 50 | $570 | $490 | $520 | $600 |

| 60 | $870 | $750 | $790 | $990 |

What we love:

- In network with any Kaiser Permanente health facility in multiple geographies across the country

- Integrated structure

- Easy Enroll options

- Recommended for ICHRA

Lowest cost by metal tier for Kaiser Permanente in LA

|

Age |

Bronze | Silver | Gold | Platinum |

| 20 | $230 | $290 | $320 | $360 |

| 30 | $270 | $340 | $370 | $420 |

| 40 | $300 | $380 | $420 | $470 |

| 50 | $420 | $540 | $580 | $660 |

| 60 | $640 | $810 | $880 | $1,000 |

What we love:

- Drive Thru flu shots and vaccines

- Family Resource Centers provide free health education classes, exercise classes, and health screenings.

Lowest cost by metal tier for L.A. Care Health Plan in Los Angeles

|

Age |

Bronze | Silver | Gold | Platinum |

| 20 | $210 | $260 | $270 | $300 |

| 30 | $240 | $300 | $310 | $360 |

| 40 | $270 | $340 | $350 | $400 |

| 50 | $380 | $470 | $500 | $560 |

| 60 | $580 | $720 | $750 | $850 |

What we love:

- Free Pacify App that supports video calls with infant experts

- Virtual doctors visits

- AutoPay eligible

What we don't love:

- Really bad customer service

- On-exchange plans only

Lowest cost by metal tier for Molina in Los Angeles

|

Age |

Bronze | Silver | Gold | Platinum |

| 20 | $250 | $260 | $280 | $310 |

| 30 | $300 | $310 | $320 | $370 |

| 40 | $340 | $350 | $360 | $410 |

| 50 | $470 | $480 | $510 | $580 |

| 60 | $710 | $730 | $770 | $880 |

What we love:

- Easy Enroll options

- AutoPay eligible

Lowest cost by metal tier for Health Net in Los Angeles

|

Age |

Bronze | Silver | Gold | Platinum |

| 20 | n/a | $260 | $340 | $410 |

| 30 | n/a | $300 | $400 | $480 |

| 40 | n/a | $340 | $450 | $540 |

| 50 | n/a | $480 | $630 | $760 |

| 60 | n/a | $730 | $960 | $1,150 |

What we love:

- Talk to a doctor 24/7 for $0

- Free telehealth

- Earn $1/day for meeting step goals (up to $100!)

- Prescription refills over the phone

- Great customer service

- AutoPay eligible (TBD)

- Easy Enroll options (TBD)

- Recommended for ICHRA

Lowest cost by metal tier for Oscar in Los Angeles

|

Age |

Bronze | Silver | Gold | Platinum |

| 20 | $250 | $310 | $340 | $450 |

| 30 | $290 | $360 | $390 | $530 |

| 40 | $330 | $400 | $440 | $590 |

| 50 | $450 | $560 | $620 | $830 |

| 60 | $690 | $850 | $940 | $1,1260 |

For rates in your area based on your age, family size, and other variables, check out our window shopping tool!

How do I choose the best individual insurance plan for me?

One of our favorite things about ICHRA is that it allows employees to choose the best plan for them, as opposed to a one size fits all group plan where they only have one or two options. At Take Command, we have tools to help employees sort through the options.

- Doctor search: Try out our doctor search tool to ensure that your trusted doctors stay in network with your new health plan. Try out our window shopping tool and search for plans that work with your doctors!

- Prescription search: Prescriptions can also be a big expense! Different carriers cover them differently, so it’s important to price check and take a good luck at formularies for all of your health plan options, especially if there’s something you take regularly to manage chronic conditions. Our new prescription search tool allows you to compare plan coverage and formularies side by side to find the best coverage at the lowest cost to you. Check it out here.

- Be informed! We've put together an Open Enrollment Guide that will give you all of our best tips and tricks.

How Take Command can help

With an abundance of quality health insurance plans for employees to choose from throughout the state, LA employees are positioned for success in terms of satisfaction with their ICHRA.

Have questions?

- Employees: If you are an employee looking to sign up for individual health insurance in L.A. to use with your ICHRA, our enrollment team is standing at the ready to help. You can set up a call with enrollment team here.

- Business owners: If you're a business owner and have questions about ICHRA, please schedule a time to chat with our HRA Design team to see if ICHRA is a good fit for you.

- Brokers: If you're a broker considering ICHRA as an option for a client, submit an HRA Design request to see if this is a good fit for your client.

Other questions? Email support@takecommandhealth.com or chat with us on the website. We'd be pleased to help!

→ Read our California small business health insurance guide!

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!