There is new law that can help small businesses dramatically simplify and reduce costs when offering health benefits to their employees. It's called the 21st Century Cures Act. It was backed by Republicans, signed by Obama, and is likely to be a major feature of any Republican plan to replace Obamacare. And no one is talking about it!

It enables a new benefits strategy called "defined contribution," which allows small business owners to offer better benefits for less money and less hassle. Here's how it works and what you need to know.

Better benefits for less money? Did I read that right?

With the new law, Congress created a special kind of HRA for small businesses called a QSEHRA (Qualified Small Employer Health Reimbursement Arrangement). The new QSEHRA allows small businesses under 50 employees to reimburse employees tax-free for individual health insurance and medical expenses.

This is a big deal because small businesses can now get the same favorable tax treatment using a defined contribution strategy but with a lot less hassle than if they tried to purchase a traditional one-size-fits-all small group plan.

Defined contribution means you the business owner set an amount each month that you'll reimburse your employees for their own individual policies. Many small businesses have been doing this, but in the past you'd end up having to pay expensive payroll taxes and your employees would have to pay income taxes. With the new QSEHRA, you can put everything under a tax-free umbrella and dramatically simplify benefits for your company.

What's the difference between "defined contribution" and a traditional small group plan?

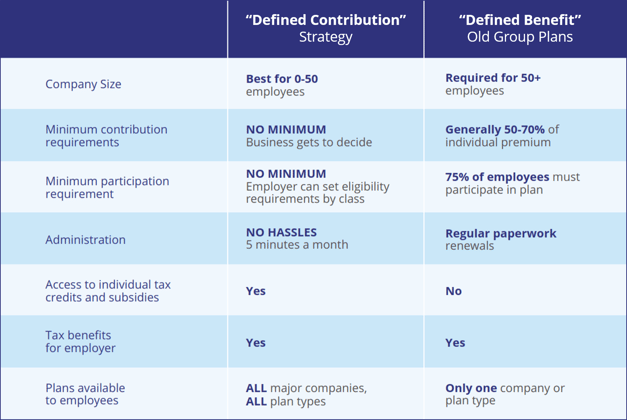

Small group plans are known as "defined benefit" plans because you the owner define how much of a benefit you want to provide (usually in a percentage). This was the old way of doing business but could cause major headaches for small businesses. Defined benefit has become too expensive, inflexible, and unforgiving for small companies. However, it used to be worth putting up with because of the favorable tax-status. However, with the new QSEHRA legislation, group plans have lost their major advantage. Here's a handy comparison chart so you can see the differences in the two strategies:

Example: Why "Defined Contribution" works better for startups

With a traditional small group plan, a company chooses a percentage of benefits to cover, i.e., 75%. If a plan cost $1,000, the company pays $750 and the employee pays $250. But what happens if the price goes up? Or employees choose a more expensive plan? The bulk of these rising costs falls on the shoulders of the employer, a burden that is really tough on small businesses whose budgets can be thrown off by unpredictable healthcare costs. In addition, you're locking your employees into a one-size-fits-all plan, with no opportunity for optimization. What if one person's doctor isn't in the network you chose?

Oh, and what happens if you're a small company and someone leaves or opts-out of the plan? Now you're in danger of losing coverage because your participation rate has fallen too low!

With defined contribution, you're taking the burden of choice, administration, and optimization off your plate. You set an amount you want to contribute, and then your employees can shop to find a plan that fits their needs best. Your dollars get optimized as employees select plans that have their doctors, cover their prescriptions, and meet their specific needs without having to overpay. Typically employers can contribute less than they would have with a small group plan and employees can get more. This is a win win!

Take advantage of this new law now!

While we wait for the repeal and replace plans that the current administration has in store for Obamacare, this is a great opportunity for small businesses to take advantage of now. Does all of this sound complicated? Expensive? Here's some good news. With our help, this can be easy and the best part is, it starts at $0 a month. Our new small business platform is here to help startups and small businesses roll out company-wide benefit plans, offering a personalized employee benefits portal, options to provide "big company" perks like dental, vision, 24/7 doctor help line, medical bill negotiation, and options to upgrade to a tax-free reimbursement HRA. Running a business is hard (our team at Take Command Health knows this firsthand!). Let us handle your company's benefits so you can get back to work.

Hungry for more? Check out the QSEHRA overview chapter of our handy new QSEHRA guide!

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!