With busy schedules and looming deadlines, looking for and signing up for a health plan can feel like a real pain.

Our experts share their insider knowledge of the health insurance industry to help you save time, sanity, and money. Here are 5 tips so you can save money and confidently find a plan that meets your needs:

1. Don't waste time hassling with Healthcare.gov or the insurance companies

We have clients contact us every year and complain "I've been on hold with [fill in the blank insurance company] for 10 hours, and can't find anyone to help me!"

Our favorite line when we talk to insurance company or Healthcare.gov reps is: "the system won't allow me to do that."

What's happening is every year around the deadline, Healthcare.gov and the insurance companies fill their call centers with part-time, seasonal workers. While most of the people answering your calls mean well, they really don't know how to help you if "their system" doesn't tell them exactly what to do.

At Take Command Health, we use data and technology to help people answer their questions. Our website is designed to help you get the best deal with the least hassle. If you do have a question, you can chat with us on the site or email us and know that you're getting connected directly with an expert (we don't staff seasonal or part-time workers). In addition, we're one of only a few websites with access directly to Healthcare.gov and have relationships directly with the underwriting departments of the insurance companies we represent. When you complete your application with us, we'll automatically route your application to the right place and keep you up to date via email of it's progress. Peace of mind with no hassles.

2. Know how to quickly see all your health insurance options

If you just go to Healthcare.gov, you'll see several options from different insurance companies, but you'll only see one type of plan. It turns out there are a universe of health plans beyond Healthcare.gov that are often more affordable and offer larger doctor networks and better coverage. These are known as "off-exchange" plans and they count as full coverage so you're not subject to Obamacare tax penalties. The same thing happens if you just go to one insurance company's website too. We see too many people get hemmed in because they don't know where to start.

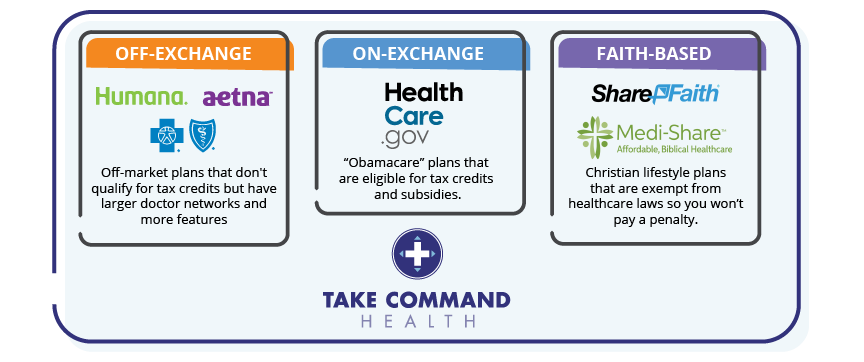

At Take Command Health, we've assembled the largest collection of Healthcare.gov plans, private "off-exchange" plans, and even some faith-based options which may be of interest to some in one place. If you need a tax credit and the best plan for you is on Healthcare.gov, you can sign up through us and we'll automatically route your application there. If the best plan for you is offered only "off-exchange", we'll send your application directly to the insurance company.

Take Command Health is an easy way to compare all plan types in one place:

3. Keep your doctors "in network"

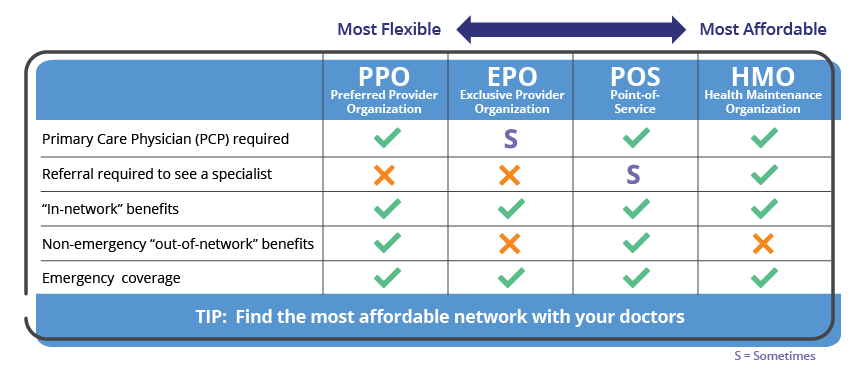

Keeping your favorite doctors "in network" is critical to saving money. If you try to see a doctor that is out of network, your health plan won't help very much or may not pay anything at all. Many people are familiar with "PPOs" and "HMOs" but there are actually several options in between that are worth considering. Here's a chart that explains the different network types:

While PPOs provide the most flexibility, they are also the most expensive. If you can find your doctor on an HMO or EPO, you could save some money. We've built a the first universal doctor search tool that let's you quickly search for your doctor across all plan types and networks. Don't waste time digging through each insurance company's site or calling every doctor. When you go through our survey at Take Command Health, we'll help you search for your doctor or you can use our stand-alone doctor search tool to quickly search for your doctor.

4. Never buy traditional dental insurance

We could go into a long explanation, but the reality is if you're buying health insurance on the individual market, dental insurance is almost always a bad idea (with 99% certainty). If you read the fine print and look at the exclusions and waiting periods, there's no way you can get more out than what you pay in. You can read more here if you're interested. Other websites, including Healthcare.gov, and brokers will try to sell you traditional dental plans because they make huge commissions on them.

Instead, we recommend dental discount plans. These plans are very cheap, start right away, and give you access to an insurance company's dental network and negotiated rates. It's like buying a Sam's Club or Costco membership. The math here is much more favorable for individuals. Dental discount plans typically cost $100/yr and you'll typically save about that much during your first cleaning. If you do the recommended 2 cleanings a year and have other family members participating on the plan or need additional dental work, you'll come out way ahead.

At Take Command Health, we've negotiated with Aetna's dental network to secure discounts for our members. We make signing up a piece of cake. Although Aetna is one of the larger dental networks, if your dentist doesn't participate, we'll help you find a discount dental plan that does include your dentist.

5. Maximize credits and savings opportunities

Finally, it's important to not leave any money on the table. We see many individuals assume they're not eligible for tax credits when they actually are. Depending on where you live, a family of 3 or 4 that makes $90,000 a year will likely qualify for a tax credit.

Other ways to save:

- Telemedicine

- Pharmacy discount cards

- Bill negotiation

At Take Command Health, we've negotiated deals that allow our members to call a doctor 24/7 for $0 to get basic prescriptions. As health plan deductibles continue to increase, if you have a sore throat, you can go to the doctor and pay ~$200-250 for a visit or you can call a doctor for free. We've also partnered with Refillwise to provide each of our clients a discount pharmacy card. If you're paying cash for prescriptions, this can help get costs down 20-60% depending on the prescription. Finally, we see many people overpay for their medical bills. We've set up a service that allows our members to take a photo of their medical bill, and have experts review it to either tell you it's correct or negotiate on your behalf. A great way to make sure you're not overpaying.

Next steps

If you're looking to get a health plan that'll help you and your family save money but don't want to spend forever digging around the fine-print from health insurance companies or waiting on hold with Healthcare.gov, we would love for you to try our free service. We'll walk you through a short online interview to help you discover all of your options, search for your doctors and prescriptions, and even help you simulate conditions. We'll then recommend the plan that we think will minimize your total costs over the course of the year. It's free to try and only takes a few minutes. Click the button below to get started!

Let's talk through your HRA questions

I wrote this blog to help people make smart health insurance decisions. I am a small business owner, a husband, and a dad to three boys, so I've seen firsthand how important understanding insurance decisions can be. As a co-founder of Take Command Health and a licensed health professional, I've been recognized as a leading expert on healthcare transparency and defined contribution arrangements (QSEHRA). I've been featured in the New York Times, Wall Street Journal, Dallas Morning News, Forbes and others. Learn more about me and connect with me on our about us page. Thanks!