Healthcare re-reform was inevitable

Donald Trump and the Republicans will almost certainly be making changes to Obamacare. Before you get excited or panic depending on your political leanings, realize that they have to. Obamacare is dangerously close to an insurance death-spiral and without some fixes would have likely faded out of existence in another year or two anyway. Hillary would have needed to make some serious changes too.

But where do we go from here? My partner Amy wrote a great article about the pieces of Obamacare that are likely to stick around. However, we think the national commentary and discussion in the media is focused too much on discussing insurance premiums and completely missing the real issues: the underlying cost of medical care and the misalignment of incentives in the market.

Trumpcare must focus on medical costs to be successful

To be clear again, I’m not talking about the cost of insurance, I’m talking about the cost of medical services—doctor visits, prescriptions, medical equipment, etc.

Insurance is just a mechanism to spread the costs of medical services around. If 'America' has a $1000 medical bill, someone or something has to pay it—it could come from insurance companies (who collect premiums from you) or it could come from government tax-credits and subsidies (which come from taxes you pay). If we try to ignore the bill, well, then you still end up paying because your premiums or taxes get higher to make up the difference. Either way, the cost comes back to you, the individual American citizen, to pay your and everyone else's medical bills.

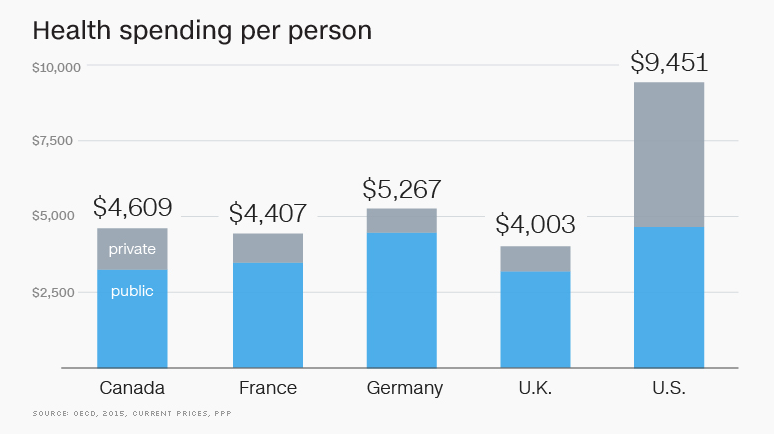

In some sense, it doesn’t really matter how we spread the costs around (via taxes or private insurance premiums) if we’re paying too much to begin with. Look how our health spending compares to Canada and Western Europe (credit CNN Money):

The reality is we’re paying twice as much per person to keep our population healthy. For the next iteration of Obamacare or Trumpcare or whatever it’s called to be successful, medical costs need to be addressed.

So, what’s driving up medical costs?

Glad you asked. Yes, our population may be a little less healthy and is getting older, but not that unhealthy or that much older than our peer countries. Our costs are driven up by some structural issues in our healthcare system that we need to reform. Here are what we believe are the biggest culprits:

1. Doctors don't know anything about their costs

I love my doctor, but he is part of the problem.

Next time you visit your doctor, I want you to try something. Ask him or her:

How much will talking to you cost me? How much is that strep-test you just gave me? Of the two prescriptions you just recommended, which one will be most cost effective for me?

I bet your doctor will have no idea.

Doctors for too long have been given a pass on competing on cost and quality. They are extremely disconnected from the costs of the procedures, treatments, and medicines they prescribe. In some cases (usually prescriptions) they are actively lobbied to recommend (i.e., prescribe in a binding fashion) a new or name-brand drug that's going to either cost you directly or your insurance company more money.

I get it (kind of). If I'm in need of life-saving support in an Emergency Room, I don't care about costs. I want the best care NOW. But the majority of health costs are not in the emergency room, it's the day-to-day stuff.

To share a personal experience, I visited my doctor once after I had gotten several tick bites hiking in the woods that were healing slowly. He immediately recommended a Lyme disease blood test. Makes sense, right? However, maybe it was my fear of needles and looking for an excuse or the tight budget I was living on, but I asked the doctor how much it would cost. He didn't know. We talked with the receptionist who showed me the codes she would bill and we called my insurance. The price tag? A hefty $850. My insurance had a negotiated rate for $650 of which I would be liable for 50%, so $325. Wow! My doctor was pretty shocked too..."I had no idea," he said. He then revealed the test for Lyme disease is only 60% accurate or so and instead recommended I see how the bites were doing in a week and then we'd decide if the test was worth the expense. Thankfully, I never needed the test.

We hear about similar stories all the time from our clients. It's right for us to demand doctors come to the table, learn more about what they are charging us, and be a part of the solution.

2. Mysterious middlemen

The biggest culprits here: pharmacy distributors and medical device companies.

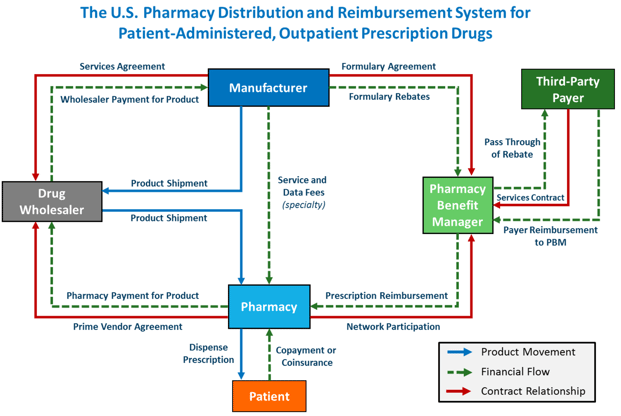

Let's look at the pharmacy industry, which is a bigger mess than most Americans realize. Drug manufacturers create product, sell it to pharmacies, who then sell it to you when your doctor prescribes it, right? Wrong. There's actually 2-3 additional steps in between, and several organizations called Pharmacy Benefit Managers (PBMs) and Switches that play both sides of the game and benefit from keeping things as opaque as possible. Here's the most simplified chart I've ever seen, and it's still confusing (credit the Drug Channels Blog):

Think about when you go to the doctor and pay your bill. The doctor has to have someone on staff to "file an insurance claim." Someone has to answer the phone on behalf of the insurance company, usually a TPA (third party administrator). The TPA then notifies someone at the the insurance company to pay a claim. The claim is usually sent to an out-sourced accounts receivable company that sees how much insurance paid, and then sends a bill to you for the remaining balance. You then pay the bill to the billing company who then passes a portion back to the doctor. All of those people and transactions have cost associated with them. What other industry in the world works like that?

We think Trump's early language on pushing Health Savings Accounts (HSAs) makes sense. In the case of an HSA, you pay the doctor directly for services, bypassing all the middlemen described above.

Finally, to be fair, we should point out insurance middlemen like ourselves too (although we are trying to be less mysterious). Each month, when you pay your premium, there's usually a broker that gets a 4-6% cut even if you purchased directly online. TPAs often get a cut too for managing company claims. For every $100 you pay in insurance premiums, there's a good chance only $80-85 actually makes it to the insurance company to cover your claims.

The challenge to untangling all this is each player is entrenched and will lobby hard to protect their turf. We hope Trump and team will take them on.

3. You (the consumer) stink at being healthcare consumers

Yes, this is a knock on you, but really, it's not completely your fault. Americans are great at buying cell phones, TVs, cars, and groceries. We know a good deal when we see it and if we're getting ripped off, we'll punish vendors.

However, we've allowed health insurance to become something that’s not really insurance—it’s a payment plan for everything. Think about your car insurance. It’s generally pretty cheap (unless you have a teenage driver) but you know that it only pays for the big stuff—car wrecks, serious property damage, etc—that would otherwise be too big a financial burden for most people. Car insurance does not pay for oil changes, paint touch-ups, car washes etc. It truly functions as insurance—protecting you from the big bills that come from catastrophic events.

Health insurance has become something different—we want it to cover everything. Every time we visit the doctor, get a generic prescription, get a flu shot we expect health insurance to pay for it and we get upset when it doesn’t. In short, we want the car wash and oil changes covered. But that’s not insurance—that’s a payment plan!

We need to bring consumerism back to health insurance. No, we don't want patients trying to diagnose themselves, but like the Lyme Disease story I shared above, patients need to learn how to ask the right questions and be their own best advocates for their care. Frankly, this is why we started TakeCommandHealth.com to help people make better decisions.

Fixing misaligned incentives

In addition to addressing the underlying costs of medical care, Trumpcare must repair the awkward incentive structure that exists in our healthcare system.

Let's take an honest look at what the incentives should be in the market and where they are now:

Patients

Incentive should be: To stay well or get better faster, save money

Incentive currently is: Avoid getting care because it's too big a hassle, expensive, or confusing or take-advantage of care because it's free

Most people should want to stay healthy, right? Are we incentivized to do so?

With the current law, everyone in the individual market pays the same premiums except for smokers. If you treat your body right, exercise, and maintain a healthy lifestyle, you pay the same amount as someone who treats his or her body poorly. Is that really fair?

Now to be clear, I'm not talking about medical conditions. I think everyone is willing to pay into the insurance pool for the kid with cancer or the adult that develops a medical condition outside of his or her control. But what about lifestyle choices that we know impacts health? If you could save $100 a month on your insurance premiums if you lost some weigh, would you be motivated?

We don't think medical underwriting should come back to the individual insurance market, but surely we can do something better to encourage patients to take better care of themselves.

Doctors and Hospitals

Incentive should be: Treat patients, keep them healthy, and make money

Incentive currently is: See as many patients as you can to bill more episodes of care

You may be surprised I put "make money" as a doctor's incentive. The reality is in our capitalist society, money should reward performance and results. Great doctors and great hospitals should make great money. Lousy doctors and hospitals should struggle unless they improve. Our current system reimburses doctors a fixed rate (usually a percentage of Medicare) so they have limited incentive to perform well, instead, they want to see as many people as they can and perform as many services in a day as they can to bill more.

A great aspect of Obamacare was the accountable care organizations (ACOs) that focused on rewarding hospital systems that provide great care for populations at a low costs. These incentives should be strengthened and focused more on the doctor-patient relationship vs being at the hospital-population level.

Insurance companies

Incentive should be: Make money while covering as many people as possible

Incentive currently is: Avoid the uncertainty of the individual market, focus on group markets they can control

I'm tired of people blaming insurance companies for high costs. Yes, they are a part of the problem, but hopefully our arguments above showed they are just reflecting higher costs in our system. The reality is Obamacare caps insurance company overhead (including profits) to just 10% of what they take in.

Insurance companies are businesses and we should encourage them to be great businesses. If we're going to go the free-market route, innovation and success should be rewarded with out-sized profits versus a fixed rate. This of course assumes that the government and regulators have set forth clear rules so that insurance companies aren't cheating people in the process of making profit. Robust competition prevents insurance companies from abusing patients--if you felt you were getting bad service, you should be able to switch.

So, why are incentives broken?

Back to costs for a second. Economic theory will tell you there are two ways to control costs: you can regulate them or let free-market competition drive them down. As it stands now, Obamacare awkwardly straddles the line. Let me explain:

I used to love playing pick-up basketball every Saturday morning at a local gym. It was always great fun—except when this one guy named Steve showed up.

In pick-up basketball, the players call their own fouls. Steve was one of those annoying guys who would drive the lane, lose control of the ball, kick it out of bounds, and then call a foul on the guy who never touched him. If Steve missed a shot, it wasn't because he was a terrible shooter, it was because he was fouled - no matter what. You get the point. Playing with Steve was no fun because he was both a player and a ref and terrible at both.

Healthcare.gov is just like Steve. It's trying to be a player in the game and a referee at the same time. Healthcare.gov (actually, it's bureaucratic parent, CMS) is trying to be the marketplace and rule-setter at the same time and that leads to some fundamental problems and twisted incentives.

In my opinion, I think Obamacare would be better if Healthcare.gov didn't exist. In other words, the government should set policy (the rules of the game) and be the referee, but get out of the game of trying to enroll people and instead let private insurers compete. Now, some will disagree and say that the government should step in as the only player (i.e., a single-payer system). Frankly, we can debate the merits of both approaches - fully private or fully public insurance - but it's likely either approach would be more economically sound than what we have now. What we have now is a Steve.

This "play it both ways" approach creates a misalignment of incentives at the top that trickles all the way down through the system:

- If you're Healthcare.gov, do you want to enroll as many people as you can to satisfy political demands or enforce your own rules to create a stable insurance market?

- If you're an insurance company with shareholders, do your risk participating in the individual market where the rules (and enforcement thereof) are uncertain or do you stick to what you know in the group market? See our article on Aetna's motivations.

- If you're a hospital with a limited number of beds, do you accept marketplace plans that reimburse less or do you only accept group plans that pay more?

- If you're a doctor with a fixed billing rate, do you try to see more patients in a day to initiate more claims or do you try to see fewer and try to do a better job?

What's next?

We hope the national discussion will focus less on the cost of insurance, which is more of a symptom, and instead focus on the critical issues: the underlying cost of medical care and misaligned incentives.

Addressing costs will take a clear vision and resolve to take on the middlemen and lobbies that will undoubtedly fight back. We can do our part as consumers by educating ourselves and working with our doctors to make sure we're getting and paying for care that makes sense.

Incentives will have to be fixed by clear rules and enforcement. Unfortunately, CMS and Healthcare.gov are playing both ways from the top, creating uncertainty and misaligned incentives all the way down the chain.

Please share your thoughts in the comments below. If you agree, please share with your colleagues and friends so we can get the discussion focused on the right things.

Finally, we built TakeCommandHealth.com to help you be a better consumer. If you or someone you know are looking for a health plan in 2017, our transparency tools are built to help you see all your options and save money by making smart decisions on doctors, prescriptions, and health needs.

Let's talk through your HRA questions

I wrote this blog to help people make smart health insurance decisions. I am a small business owner, a husband, and a dad to three boys, so I've seen firsthand how important understanding insurance decisions can be. As a co-founder of Take Command Health and a licensed health professional, I've been recognized as a leading expert on healthcare transparency and defined contribution arrangements (QSEHRA). I've been featured in the New York Times, Wall Street Journal, Dallas Morning News, Forbes and others. Learn more about me and connect with me on our about us page. Thanks!