We've updated our Arizona guide for 2019 open enrollment.

Did you know that 11% of Arizonans are without health insurance totalling 770,000 in all? Arizona has seen great improvements in reducing the number of uninsured since the Affordable Care Act rolled out in 2012 when the number of uninsured made up 18% of the population. However, Arizona still remains above the national average of 9.1%. Premium increases and fewer carriers are pricing many Arizonans out of the market. However, there are still options available and we have some great tips if you are in the market for a new plan.

Be a smart shopper

Did you know that more than 88% of Americans choose the wrong health insurance plan and end up wasting on average over $500 a year on health expenses? Buying health insurance can certainly be overwhelming. Here are some tips on what to look for when shopping!

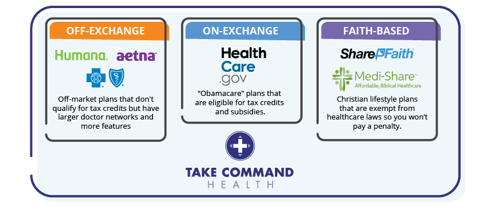

- Know your options There are several ways to purchase health insurance in Arizona. One place to find plans is at Healthcare.gov. These plans are called “on-exchange” plans. But did you know that only a small percentage of plans are available “on exchange?” Another option is to go directly to an insurance company’s website to find their “off-exchange” plans. But who has time to research every carrier in Arizona this year to compare plans? There must be an easier way! Take Command Health can help you quickly see ALL of your options. We have plans from all the major carriers that you’ll find “on exchange”, many of their “off exchange” plans, and even the faith-based plans like Medi-Share which are increasing in popularity.

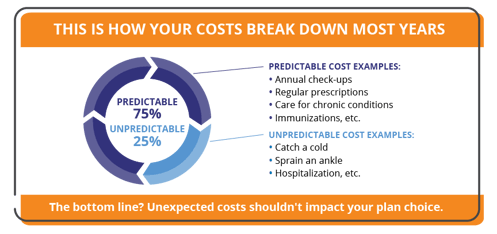

- Estimate your out-of-pocket costs. Over 75% of your costs in the next year are predictable based on your known needs. Let that sink in for a minute. That means you can pick out a plan that suits your needs if you just take 5 minutes thinking about what you expect medically next year. What really drives costs, and therefore your plan choice, are the things you know about: prescriptions, medical equipment, therapy, and doctor visits. If you’re healthy, maybe you plan on none of these things–which is just as important to know too.

So which plan will cover your known needs the best and minimize your out-of-pocket expenses? At TakeCommandHealth.com, we’ve read all the fine print on deductibles, co-pays, and coinsurance for you. You can quickly search for your prescriptions or tell us about any health needs you are managing such as “physical therapy” or “having a baby.” We’ll run all the numbers for you and help you estimate your out-of-pocket costs on each plan!

So which plan will cover your known needs the best and minimize your out-of-pocket expenses? At TakeCommandHealth.com, we’ve read all the fine print on deductibles, co-pays, and coinsurance for you. You can quickly search for your prescriptions or tell us about any health needs you are managing such as “physical therapy” or “having a baby.” We’ll run all the numbers for you and help you estimate your out-of-pocket costs on each plan!

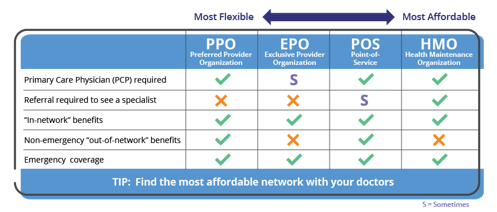

- Know your doctor preferences. Provider networks are becoming increasingly limited each year, especially in Arizona. This means that “in network” is going to be more important as insurance companies are going to pay less and less if you see an out-of-network provider (unless it’s an emergency, of course).

The more “flexible” you are with which doctors you see the greater savings opportunity you have. If you don’t have many preferred doctors, consider an HMO. You still get coverage for emergencies anywhere in the country and many companies offer referrals by phone or online.

The more “flexible” you are with which doctors you see the greater savings opportunity you have. If you don’t have many preferred doctors, consider an HMO. You still get coverage for emergencies anywhere in the country and many companies offer referrals by phone or online.

EPOS are often cheaper and more readily available than PPOs and are a great option if you have a lot of doctors you want to see or if you don’t want to have to get a referral to see a specialist. At TakeCommandHealth.com, we have a first-of-its-kind universal doctor search tool. Search for your favorite Arizonian doctors and we’ll tell you which networks and plans they accept.

- Utilize savings memberships to reduce overall costs! High deductible plans are increasingly the norm, but they tend to dissuade the user from seeking medical care when needed which leads to more expensive medical care down the road. What if there was a way to still get medical care but at a reduced cost? Take Command Health Premier Membership offers customers free telemedicine, bill negotiation, pharmacy and dental discounts. The premier membership plan supplements your health insurance and helps you save money every time you use it!

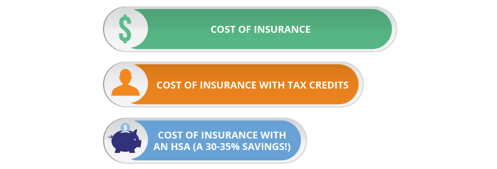

- Take advantage of tax credits! Many individuals assume they're not eligible for tax credits when they actually are. Depending on where you live, a family of 3 or 4 that makes $90,000 a year will likely qualify for a tax credit. This means there is a good chance a tax credit is waiting for you! At TakeCommandHealth.com, we’ll help you quickly determine if you’re eligible for tax credits and automatically apply them to your plan each month avoiding the hassle of Healthcare.gov.

Take Command Health is here to help

If you're looking for individual health insurance in Arizona that'll help you save money but don't want to spend weeks researching, we would love for you to try our free service at Take Command Health. Give us 5 minutes and we’ll give you the best plans in your area that cover your needs. Click the button below to get started!

Let's talk through your HRA questions

I wrote this blog because I love helping people decode confusing insurance jargon and understand the fine print. I'm a licensed health insurance professional and specialize in simplifying health insurance for individuals and small businesses. My QSEHRA articles have been featured regularly on Accounting Today, Accounting Web, HRWeb, and other industry publications. I'm also a member of Take Command Health's client success team and a full-time mom. Learn more about me and connect with me on our about us page. Thanks!