QSEHRA benefits small businesses and startups with fewer than 50 employees looking to offer small business health insurance to recruit and retain talent and take care of their teams. The Qualified Small Employer HRAs (QSEHRA) allows owners to reimburse employee medical expenses and health insurance premiums tax-free. HRAs provide cost savings for employees and increase insurance flexibility for employees. Let's talk about QSEHRA benefits!

Every smart business owner knows the key to running a successful business is to have the right people on your team. But how do you attract and retain the best and brightest while increasing the bottom line? One word...benefits! And no, we are not talking about Silicon Valley benefits of casual Friday and free lunches. Employees want and need real benefits. Not offering health benefits is a major drain on your revenue for many reasons including increased turnover and hiring costs.

QSEHRA Benefits

Here are three reasons why HRAs may be a good fit for your company in your pursuit of small business health insurance options.

Savings through Fixed Costs

Businesses that want to provide health insurance for their employees are faced with rising costs each year that are rapidly outpacing inflation. According to a survey by the Department of Health and Human Services, the average cost of individual health insurance for an employee in 2001 was $2,889. In 2015, the cost had risen to $5,963, exceeding both inflation and wage growth. With an HRA, companies are able to budget better and fix their costs, eliminating group plan increases. Employees are only reimbursed for amounts they spend up to their maximum allowance. Most companies find that employees utilize about 87% of their allowance.

Attract and Retain Employees

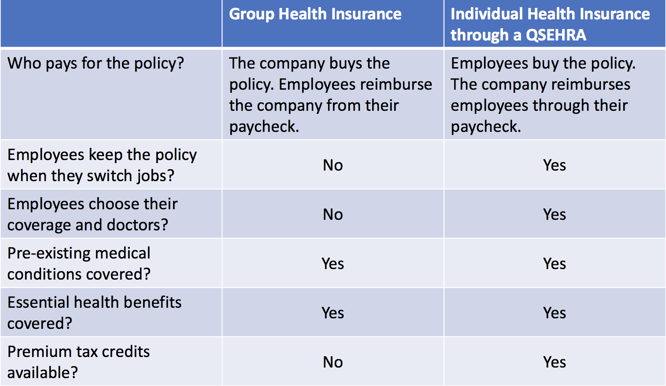

Employees are looking for employers offering health benefits, and 69% of job seekers would prioritize job offers based on health benefits. HRAs provide employees choice and portability when it comes to health insurance. Employees are able to purchase the best plan for their needs (with their preferred doctors) instead of being forced into a one-size-fits-all group plan. When it is time for the employee to switch jobs, they will still have insurance coverage, eliminating the need for costly short term options through COBRA. Employee HRA reimbursements stop when the employee leaves the company.

Tax Free Reimbursements

Everybody loves to save money on taxes, and utilizing an HRA is one way to do it. Businesses typically save 7.65% in payroll taxes and employees save 20-40% in state and federal income tax on money spent on health insurance premiums and medical expenses reimbursed through HRAs.

Why health benefits for small business is important

Employees are attracted to benefits, particularly health benefits. 69% say they would accept one job over another if it offered better benefits.

Businesses not offering benefits are 4x more likely to have voluntary employee turnover than their counterparts offering health benefits.

In addition to losing out on talented employees, it generally costs 6-9 months of salary in recruiting and training expenses to train a new employee.

To replace an employee making $40,000 a year would cost $20,000-$30,000.

Five employees leaving in one year for the same position with benefits will cost your business $100,000- $150,000!

→ Read this foundation client's story of their experience with Take Command and their QSEHRA review!

The problem with health stipends

Many businesses believe if they give their employees a raise, instead of group health, the employees will use the extra money to purchase their own health benefit.

This is flawed reasoning.

Employees do not consider this extra money a “benefit” and very rarely put the money towards their health. The huge problem with this method is that it increases the employee’s taxable wages.

Businesses now have to shell out more money in payroll taxes including Social Security and Medicare.

If your business with 30 employees gives each employee an extra $3,000 to purchase health insurance, you will now be spending an additional $90,000 a year on salary and an additional $6,805 in payroll taxes.

This is still less than what would be spent on a group health plan, but it hasn’t solved the problem of losing employees to companies offering health benefits.

Ready to learn how much you can reduce benefits cost?

Affordable health options for small businesses

Group health plans are too expensive for most small businesses, but so is skipping health benefit altogether. One option businesses should consider is a small business HRA built entirely for them.

It's called a QSEHRA. These new HRAs are a great way to offer affordable small business health insurance benefits to your employees.

→ Check out our 5 tips for choosing a small employer health insurance plan

→ Compare QSEHRA vs ICHRA to see what's best for you.

Small business HRA benefits

QSEHRA benefits are great for everyone, from the employer to the employee. It's a win-win.

HRAs are tax-free alternatives to group health insurance and enable you to set your budget. Let’s say you still want to give your employees $3,000 to purchase health insurance. The HRA will save you the additional $6,805 in payroll taxes you would have paid if you had given that money to your employees as a wage increase. Employees submit their medical expenses up to the monthly allowance for reimbursement (also tax free). The HRA is considered a formal benefit, so employee retention will increase once the HRA is in place, saving the hiring and training costs associated with replacing lost employees.

→ Read this QSEHRA review of Take Command from an IT consultant!

More benefits include:

- Flexibility: employers are locked in to

- Personalization: employees choose the best health plan for them based on their family's unique needs.

- Cost savings: employers can set a budget and stick with it. No pricey renewals.

- Portability: Employees can take their health plans with them if they move on to another job.

Still have questions about QSEHRA benefits?

Take Command makes setting up a QSEHRA for your business easy (read about our QSEHRA administration here). Our team will help you set your budget, take care of the admin paperwork, and help your employees pick a plan that suits their needs.

No need to worry about finding the perfect plan that has the right doctor network or prescription coverage, ultimately leaving someone left out and disgruntled.

With the HRA, each employee picks the perfect plan for them that fits within your budget.

Hungry for more? Get started with the QSEHRA benefits chapter of our handy new QSEHRA Guide!

→ Read up on how ARPA affects COBRA and QSEHRA.

More questions on QSEHRA benefits?

As you can see a small business HRA provides great value for both small businesses and their employees. Take Command makes HRAs really easy and affordable (no set up fees)! Our expert team will help you set up your HRA, onboard your employees, and take care of the compliance and reporting hassles so you can focus on running your business.

Hungry for more? Check out the benefits chapter in our handy new QSEHRA Guide!

Let's talk through your HRA questions

I wrote this blog because I love helping people decode confusing insurance jargon and understand the fine print. I'm a licensed health insurance professional and specialize in simplifying health insurance for individuals and small businesses. My QSEHRA articles have been featured regularly on Accounting Today, Accounting Web, HRWeb, and other industry publications. I'm also a member of Take Command Health's client success team and a full-time mom. Learn more about me and connect with me on our about us page. Thanks!