We published this guide in an effort to assist business owners who are researching their options for health insurance. While we are an HRA administration company we recognize HRAs are not always the best fit, so we took our expertise with small businesses and familiarity with health insurance and produced this guide.

Health Insurance for Small Business

Employers beginning the process of providing small business health insurance for their employees typically have more questions than answers.

Here are the most common questions this guide to small business health insurance will address:

- What are the available insurance options?

- What is the cost of small business health insurance?

- What does the process to get started look like?

- What are the Pros and Cons of each option?

- How much will health insurance cost?

- What are the legal requirements?

- What are the tax implications?

- Where should an employer get started?

This Small Business Health Insurance Guide will provide information to help employers make the best decision possible regarding health insurance for their company.

This guide is for employers with less than 50 employees researching health insurance for small business.

Which HRA is right for you?

Getting started with small employer health insurance

Here are five helpful tips as you weigh your options for small employer health insurance. Small businesses have their unique needs as growing companies, and so do the small business insurance plans that work best for them. Before talking to a health insurance company or small business health insurance broker who sells health insurance, take the time to consider our 5 tips.

Consider the below your homework!

- Learn about the basics of offering health insurance.

As a small employer, you probably know that federal law only requires employers with 50 or more full-time employees to offer healthcare coverage. This means small employers are not required to offer healthcare coverage. But offering healthcare could help you come tax time. As a small business owner, you may be able to deduct the cost of healthcare premiums from your taxes. Additionally, if you offer small business health insurance to your employees, they may be able to exclude the value of their coverage from their taxable income. - Understand what your employers need for healthcare.

Just like each employee is unique, so are their healthcare needs. It’s important to understand what kind of coverage your employees need and are looking for from their employer-sponsored healthcare plan. Gaining insights into employees' preferences will help you determine what type of plan and coverage to offer with your small employer health insurance.

Do your employees have a preferred network of care? If most of your employees prefer a particular hospital or doctor, it may be worth considering a plan that includes them in-network.

What kind of health insurance coverage do your employees need? Are your employees looking for basic coverage or do they need something more comprehensive for health insurance? Understanding what your employees are looking for in terms of specific health insurance coverage will help you narrow down options and find the right plan for small employer group health insurance.

Suggestions on ways to gather insights:

- Distribute an anonymous survey

- Encourage employees to email a human resource representative

- Speak directly to employees

- Determine a budget.

Healthcare is a great benefit to offer your employees. But it’s important to understand your budget before searching for healthcare coverage. This will help you to better navigate costly quotes. To give you a ballpark estimate, the Kaiser Family Foundation in 2021 reported the average annual cost of employee health insurance premiums for a self-only plan was $7,739. Premiums for small business employee health insurance are typically shared between the employee and employer; the percentage may vary in different states and/or insurance providers. - Understand the benefits of offering health care coverage.

The job market is competitive. Recruiting and retaining talent takes time and money. According to a 2022 Investopedia article, hiring costs go beyond the salary. When you factor in recruiting, screening, and training employees, even an $ 8-an-hour employee can cost $3,500 in turnover costs. By offering small business healthcare benefits, you help your chances of keeping employees long-term. According to an America’s Health Insurance Plan (AHIP) survey, health coverage was a key factor for 56% of employees when deciding whether to remain at their current jobs.

Not only do you have a better chance of attracting and keeping talent, but employees may also make for better workers.

According to the CDC, a workplace health plan can increase productivity and reduce absenteeism. These are both great benefits to employers.

- Know your options.

It's important to understand that different types of small business health insurance plans are available, and each has its own set of pros and cons. Most people think of group insurance when they think of health plans; however, there are also HRAs, Health Reimbursement Arrangements. This guide covers them all!

Types of Healthcare for Small Business

Historically speaking, small-group insurance has been the primary option for many small employers who are looking to offer health benefits for their employees.

While these plans are the most widely known and understood, they are not the only option. There are multiple ways to provide benefits for your employees.

Here are the four most common methods:

Do small businesses have to offer health insurance?

Small business owners often wonder whether or not they actually have to offer health insurance. The answer is no, small businesses are not required to offer health insurance for employees.

The Affordable Care Act states that only large employers (applicable large employers with 50 or more full time equivalent employees) are required to offer affordable health benefits that meet minimum essential coverage. While large employers face penalties if they fail to comply, small businesses do not.

But there are plenty of great reasons to offer group benefits for small businesses. Recruitment, retention, and simply taking care of your employees are a few!

Group Health Insurance for Small Business: Know your options

When asked about health care for small business, most people envision the model of small-group insurance (sometimes referred to as “fully funded”).

That’s because it’s the model of insurance with which most people have experience. While it is the standard-bearer of employer-sponsored benefits, group health insurance for small business remains difficult to understand both for employers and employees alike.

In 2018, 29.8% of employers with fewer than 50 employees offered a small group insurance plan to at least some of their employees.

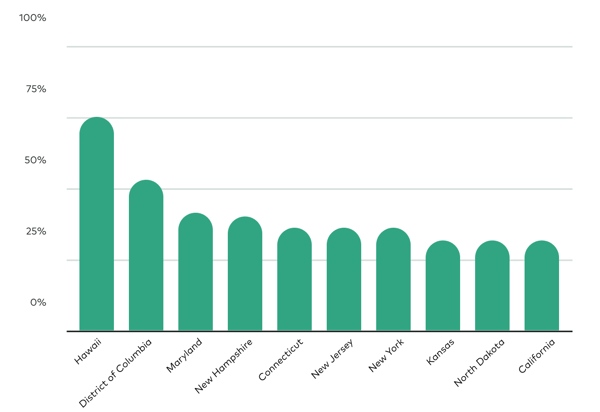

Data from The Kaiser Family Foundation reveals that employers in Hawaii were the highest contributors (74.9%), while employers in Utah were the lowest contributors (17.5%).

NOTE: Hawaii's Prepaid Health Care Act (or PHCA) accounts for the high percentage of coverage.

How does small-group insurance work?

The process typically begins with a conversation with a small business health insurance broker—although a broker is not absolutely necessary.

What are small business health insurance brokers?

Small business health insurance brokers are the go-between for employers and insurance companies (also called “underwriters” or “carriers”), and they are the ones who do most of the upfront work in finding a plan for employers.

Typically, brokers will collect a company’s employee information into one document (called a “census”) and use that to begin finding the ideal plan for their clients.

Census information usually includes: name, age, date of birth, number of dependents, and zip code.

The broker (or sometimes, the employer) will submit the employee census to various carriers and begin the process of collecting multiple quotes.

It’s worth noting that brokers will not be able to negotiate better pricing with carriers.

This is because the insurance plan premiums (aka “rates”) are filed with and approved by the state-level Department of Insurance on an annual or quarterly basis.

Do I need a small business insurance broker?

The real value with small business insurance brokers is their streamlined ability to collect quotes based on the employee census as well as creating a bundle of ancillary products that add value to all employees (i.e. dental, vision, FSA, HSA, etc.). By law, brokers are not permitted to mark-up pricing on group plans.

A good small business insurance broker will help educate a client and explore possible solutions to providing benefits to their staff. Small business health insurance brokers provide employers peace of mind and industry experience.

Brokers do not, however, provide unique proprietary insurance products that are unavailable elsewhere.

Wondering how you could design your HRA?

It’s worth noting that many brokers’ primary income comes from making a commission (or “finder’s fee”) from the insurance company the employer selects. This fee is typically based on the number of employees that enroll in the selected plan (or a percentage of premiums paid) and is typically built into the cost of the group plan.

About the Small Business Health Options Program

If an employer chooses to search for a small group plan on their own, they can use Healthcare.gov’s Small Business Options Program (SHOP) Marketplace, locate a private exchange, or search directly with the various carriers.

Once a small business insurance company reviews the employee census, they will determine the risk associated with that particular small business health insurance company and create an appropriate cost for underwriting the company.

What this means is the small business insurance company will take into account all of the employees and their projected/expected health needs and risks for the up-and-coming plan year and establish a dollar amount (or “fixed premium”) for the employees to offset the risk they are about to inherit.

The Affordable Care Act (ACA) and prior state-specific regulations created what’s called “community rating” for small group health plans.

This means that while carriers in most states can vary premiums by age and location, the health status of individual employees has no bearing on the cost of the health insurance plans. Insurance companies cannot charge a small business client more or less because their employees are either sick or healthy.

The "employer contribution" is the portion of the employee's fixed premium that the employer chooses to cover.

Once the broker has collected quotes for the employer (the number of options presented as well as types of “bundled” ancillary products will vary depending on each broker), they will present the options and typically make recommendations based on the company’s needs.

Employers then select the insurance carrier and plan design option(s) they will offer employees.

Once a plan is selected, the employer determines how much of the fixed premium they want to cover (also known as the “employer contribution”) and while each employer’s contribution varies based on their location and preferred carrier, most states require that businesses contribute at least 50% of the total fixed premium for each employee.

About the Small Business Health Care Tax Credit

Some small employers may qualify for the Small Business Health Care Tax Credit which helps businesses (less than 25 employees) offset the cost of their contributions up to 50 percent if they use the SHOP.

According to The Kaiser Family Foundation, in 2019 small business employers contributed on average 71% of the premiums for their employees with family coverage and 83% for employees with single coverage.

In fact, for single coverage employees, small employers covered 100% of the premium for 31% of all employees while 35% of employees received less than half.

Employer Contributions |

|

|

|

Family Coverage (71%) |

Single Coverage (83%) |

Employer Health Insurance Costs: What to Expect

Every year, community-rated premiums are recalculated based on the previous year’s usage and the carriers’ projections for the up-and-coming year.

While not always the case, premium rates often increase year over year. In 2019, group health insurance rates outpaced both inflation and worker’s salary increases.

The average premium for single coverage for 2019 was 4% higher than the previous year, and the average premium for family coverage was 5% higher as well according to The Kaiser Family Foundation.

Over the past five years, small businesses saw an estimated 28% increase in annual family premiums.

Once a plan is selected, the employer typically holds a meeting to present the plan to the employees and begins the process of getting them enrolled.

If a broker is involved, this process is oftentimes handled by the broker.

Small-group plans require participation rates in order to effectively manage the risk. As an example, Healthcare.gov’s SHOP requires a 70% participation rate in order to honor the quoted fixed premium.

What are the pros and cons of small group insurance?

| PROS | CONS |

| Tax-Free for employers & employees | Fluctuating yearly costs |

| Well known model | Required participation rates |

| Great products available | Subject to potential risks |

| Employees don’t have to think too much | True cost of care hidden from employees |

| Perceived as an excellent recruiting tool | Little plan flexibility |

NOTE: this is not a comprehensive list of the pros and cons.

What is self-funded health insurance?

Self-funded health insurance is a type of self-insurance where the business pays for its employees’ medical expenses with its own funds rather than leveraging an insurance carrier.

In this manner, the company is assuming all the health risk instead of an underwriter and therefore, this type of insurance is most often used by large employers with plenty of cashflow to handle the totality of the incoming employee claims and mitigate the potential risk.

Self-funded health insurance is oftentimes used by larger companies with dedicated staff and wellness programs in place.

While not uncommon with small employers, the vast majority of employers opting for this option are large/enterprise-level companies.

In fact, 81% of covered employees who work for a company with more than 200 employees were part of a self-funded plan.

Only 13% of covered employees at companies with 3 to 199 employees were part of a self-funded plan.

Self-Funded Health Insurance |

|

|

|

200+ Employees (81%) |

3 to 199 Employees (13%) |

How Many Employees Do You Need Before You Must Provide Health Insurance?

Under the Affordable Care Act (ACA), businesses must provide health insurance if they have 50 or more full-time equivalent (FTE) employees. This mandate is part of what's known as the Employer Shared Responsibility Provision. Companies falling under this requirement must offer affordable health insurance and minimum value to their full-time employees and their children up to age 26, or they may face a penalty. Providing health insurance is optional for businesses with fewer than 50 FTE employees. It comes with certain flexibilities and incentives, such as offering a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) or participating in the Small Business Health Options Program (SHOP).

Do Small Businesses Pay More for Health Insurance for Their Employees?

Small businesses often face higher per-employee health insurance costs than larger companies. This discrepancy is primarily due to small businesses' smaller risk pool, administrative fees, and lack of bargaining power in the health insurance market. Insurers often charge higher premiums for small groups because the risk is spread across a smaller number of individuals, which can result in more significant variability in healthcare usage and costs.

However, there are ways for small businesses to manage these costs and still provide valuable health benefits to their employees. Exploring alternative health benefit options such as HRAs (like QSEHRA and ICHRA), participating in SHOP, or joining a professional employer organization (PEO) that offers access to more extensive group insurance plans can help mitigate some of these costs. Additionally, tax credits and incentives are available for certain small businesses that provide health insurance to their employees, helping lower the overall expense.

How does self-funded insurance work?

Initially, an employer will work with a TPA ( or “Third-Party Administrator”) to manage the creation of plan documents, assist with claims adjudication, and handle payments.

TPAs are only partially necessary (or legally required), but employers will need adequately trained staff to dedicate time and energy otherwise.

In 2018, only 8% of companies with 3 to 49 employees took advantage of a self-funded plan. [source: Kaiser Family Foundation]

Streamline your benefits management. Switch to a hassle-free HRA plan!

The first thing an employer will need to do is invest time in determining what benefits they’d like to provide to their employees.

Once this is determined, they’ll need to produce the legally required plan document and summary plan document (or “SPD”).

It is strongly recommended that these documents are produced in conjunction with a law firm or benefit professional—even if originally issued by a TPA.

The plan document outlines the rights of the plan’s participants and beneficiaries, as well as helps the plan sponsor and plan administrator perform their responsibilities.

These documents outline several items including (but not limited to) the proposed benefits, who can participate, and how the company intends to fund the plan. An SPD is a simplified version of the plan documents that is issued to participants explaining how the plan works in common language.

In regards to the actual funds, an employer will need to determine whether the plan is “funded” or “unfunded”.

An unfunded plan means that employees’ claims will be paid from the company’s general assets rather than a dedicated fund.

In this case, the employer will need to forecast funds to ensure steady and ample cashflow to handle employee claims.

72% of workers covered under a self-funded plan live in the Midwest region.

If the plan is funded, the company will need to set up a dedicated trust fund that collects both the corporate contributions as well as the employee contributions.

This fund will be used exclusively to pay claims from employees as they arise throughout the year.

One major benefit of this arrangement is the company’s increased control of the allocated funds which often means they are free to earn interest on this money while it is unused.

While documents are being established and funding is determined, the company should also begin the process of finding the ideal provider network that fits their company needs. While insurance carriers are often subject to exclusive in-network contracts, a self-funded company is free to choose the provider networks best suited to serve their employees’ needs.

Lastly, the employer will need to secure stop-loss insurance to cover any significant healthcare costs that unexpectedly occur like accidents or poor health diagnoses.

80% of workers covered under a self-funded plan work in the transportation, communications, or utilities industries.

What are the pros and cons of self-funded insurance?

| PROS | CONS |

| Highly customized plans for employees | Full exposure to high risk |

| Control over allocated funds (earn interest) | Large on-hand cash needed to fund claims |

| Less regulation | Complicated management |

| Provider network flexibility | Fewer consumer protections |

| Employer pockets unused funds |

NOTE: this is not a comprehensive list of the pros and cons.

Learn more: Is level-funded a good fit?

What is level-funded insurance?

In the last few years, the popularity of what’s called level-funded insurance has grown among small employers.

Think of level-funded insurance as a hybrid between self-funded insurance and fully-funded insurance (i.e., traditional small group insurance).

How does level-funded insurance work?

In a level-funded model, the employer still contributes a monthly payment to a TPA or carrier, but rather than that payment being a “use-or-lose” fixed premium like with small group insurance, the payment is held by the carrier and used to pay claims made by employees throughout the year.

At the end of the year, any unused funds are refunded to the employers (minus admin fees and payments on stop-loss insurance).

In the event that the amount of claims is over the limit, the employers’ stop-loss insurance covers the difference.

In terms of plan design, level-funded plans work similarly to self-funded plans with regards to flexibility and customization. Employees typically experience a high degree of choices and options under these plans.

Level-funded plans can be a great solution for small employers because they provide the predictability of equal monthly payments throughout the year as well the peace-of-mind of stop-loss coverage for large spikes in claims.

Year over year, if an employee group can remain healthy, level-funded plans can save employers money while also providing great plan customization for employees.

What are the pros and cons of level-funded insurance?

| PROS | CONS |

| Saves money (if employees remain healthy) | Partial exposure to high risk |

| Highly custom plan design | Vulnerable to substantial premium increases |

| Eased regulatory restrictions | Fewer consumer protections |

NOTE: Level-funding is not available in some states because of specific state regulations. This is not a comprehensive list of the pros and cons.

Can a Small Business Write Off Health Insurance?

Small businesses often write off health insurance as a business expense, providing a significant tax advantage. This deduction can apply to premiums paid on health insurance plans for employees and, in some cases, the self-employed owners themselves, depending on the structure of the business. Specifically:

- Sole Proprietors, Partnerships, and S-Corporations: If you're self-employed or an owner of a partnership or S-Corporation, you may be able to deduct 100% of your health insurance premiums, including those paid for your dependents. This deduction is taken on your personal income tax return and reduces your adjusted gross income. It’s important to note that this deduction is only available if you are not eligible to participate in a health plan through another employer (such as a spouse’s plan).

- C-Corporations: C-Corporations can deduct the cost of employee health insurance as a business expense, which reduces the company's taxable income. This includes premiums paid on behalf of the owners, provided they are employees of the corporation.

- Qualified Small Employer Health Reimbursement Arrangement (QSEHRA): Small businesses that choose not to provide group health insurance but instead offer a QSEHRA can also benefit from tax advantages. Contributions made to the QSEHRA are deductible as a business expense, and reimbursements for qualified medical expenses are tax-free for employees.

- Health Savings Accounts (HSAs): The business's contributions to employees' HSAs are deductible as business expenses, further reducing the business's taxable income.

To maximize these tax benefits, it’s critical for small business owners to keep detailed records of all health insurance-related expenses and to consult with a tax professional. This ensures compliance with tax laws and regulations while taking full advantage of available deductions and credits. This not only helps in managing costs more effectively but also provides a valuable benefit to employees, making the business a more attractive place to work.

While HRAs (or "Health Reimbursement Arrangements”) have been around for a long time, their ability to serve as a comprehensive benefits solution is very new, thanks to recent changes in regulatory rules.

What is an HRA?

These new HRAs are sometimes referred to as “401k Style” insurance. In general, HRA is an umbrella term for any legal arrangement between an employer and their employees to reimburse for medical expenses and/or insurance premiums on a tax-free basis.

Under this arrangement, employees purchase their own health insurance on the open market and then submit claims to their employer to get reimbursed for the cost of their premium and if allowed, all qualified medical expenses.

What are the HRA types?

There are several types of HRAs, but there are currently only two types that allow for employers to reimburse employees tax-free for qualified individual insurance premiums:

Over one-third (34%) of the small employers we've had conversations with over the last two years did not previously offer a formal benefits solution.

An employer begins by choosing the HRA that best fits their company (QSEHRA or ICHRA).

At a very high level, these two HRAs behave the same, but they are each designed to meet specific needs.

While not absolutely necessary, many employers choose to hire an HRA administrator to ensure the HRA is properly set up and to ensure that all regulations are correctly followed (like HIPAA).

An administrator also ensures compliance and data privacy in the long term.

HRA Setup

Before an HRA can be implemented, employers will need to produce an official HRA Plan Document. Typically in coordination with their administrator, employers design their HRA by answering the following questions:

- What will be the HRA start date?

- Which employees should be included and who will be excluded?

- What are the reimbursement limits for each group of employees?

- What types of medical costs will be reimbursable?

Once the plan document is completed, it is submitted to the IRS, and the employer is then required to communicate with their employees (called “Employee Notice”) the change in their healthcare options.

With an HRA, employees secure their own individual insurance and are then reimbursed by their employer.

Employees at this point will then secure their own individual insurance (either on the marketplace or directly with a carrier) that best fits their needs.

If this is the first time an employer is offering benefits, some employees may already have individual insurance that qualifies, and others may even be eligible to get reimbursed for their portion of their spouse’s insurance.

Employees are then allowed to begin submitting claims to their employers to get reimbursed up to the established limits.

What are the pros and cons of an HRA?

| PROS | CONS |

| Reimbursements are tax-free | Dependent on a strong individual market |

| Employers keep unused funds | Limited provider networks |

| Predictable budget year after year | Conflicts with premium tax credits |

| Insurance not tied to employer | Owner participation limitations |

| More plan choices for employees | Confusion over new model |

| No participation rates | |

| Fast and easy setup |

NOTE: This is not a comprehensive list of the pros and cons.

More small business health insurance options

While the previous options covered so far in this guide account for the majority of small businesses offering benefits, other less traditional options exist:

- Reimburse via taxable stipend: Some employers offer a regular, fixed amount of money, or stipend, to their employees to help cover the cost of health insurance. While this option is easy from a time and administration perspective, the value of these dollars will be greatly diminished because they are considered taxable income (~30%). Furthermore, simply writing off the stipend as a business expense will have payroll as well as income tax implications.

- Group Sharing Plans: A more recent alternative is group sharing plans (sometimes called “sharing ministries” because of their religious beliefs). This option doesn’t involve major carriers but rather a group of people who agree to share the medical costs of the group as they arise.

- Taxable salary increase: The simplest benefits option is a basic salary increase to cover the cost of health insurance for the employees. Similar to a stipend, however, the IRS will not distinguish these additional funds from regular income and insist that the employer pay payroll taxes. Furthermore, this money will be taxed for the employees making this option less effective in the long run.

- Do nothing: And lastly, employers with less than 50 employees are not required to provide insurance, so technically this is an option as well.

This list is not comprehensive. Each employer should continue to research options and speak with professionals before moving forward.

Read: Employer Health Benefits - 2019 Summary of Findings

Unlock tax advantages with an HRA. Find out more today.

How much does small group insurance cost?

Wondering what the cost for small business health insurance is? In 2019, the nationwide average cost of insurance for an employee was $599/mo according to The Kaiser Family Foundation. If the trends remain consistent with the last five years, employers can expect a 3% to 4% increase in cost each year, making the cost for small business health insurance higher each year.

That said, small group insurance rates will greatly vary across the board. Monthly premium costs are calculated based on a handful of key factors. Here are the key factors that determine how much small group health insurance will cost for employers:

- Employee census

- Location

- Type of coverage

- Carrier selection

- Employer contribution

Employee Census

The employee census is a quick demographic snapshot of a company’s employees and a few key pieces of information that insurance carriers will need to determine how much risk will be involved to underwrite a certain business. In general, an employee census will include the following information.

| Allowable (typically included) | Not Allowable (by law) |

|

|

NOTE: Census information can vary depending on state regulations.

Location

Small group insurance rates vary depending on the employees’ zip codes. These areas are commonly called rating areas, which depending on the state, are determined by either zip codes, counties or Metropolitan Statistical Areas ( or “MSAs”). However they are calculated, these rating areas are used by all carriers to help determine the cost of coverage. This means that all employees living within a particular rating area are treated equally when calculating cost of coverage.

Type of Coverage

Also affecting the cost of small group insurance will be the type of provider network chosen and the type of plans offered to employees. The primary difference between these types is how that particular network handles in-network and out-of-network care. While there are multiple choices, we’ve listed the most common options here:

Common Provider Networks:

- Health maintenance organizations (HMOs)

- Preferred provider organizations (PPOs)

- Exclusive provider organizations (EPOs)

- Point-of-service plans (POS)

- Learn more about provider networks

In 2019, 44% of covered workers had a PPO, according to The Kaiser Family Foundation.

Common Plan Types:

- Platinum (90% coverage for employees)

- Gold (80% coverage for employees)

- Silver (70% coverage for employees)

- Bronze (60% coverage for employees)

The Affordable Care Act (ACA), also known as Obamacare, standardized individual and small-group insurance plans into the metal tier system to make it easier for consumers to compare plans. Click here to learn more about coverage options.

Carrier Selection

Because all carriers price their products differently based on several variables, similar coverage will vary greatly from one carrier to another.

Aside from fixed costs like overhead and internal budgetary expenses, carriers also must align pricing based on contractual agreements with entities like doctors, hospital networks, and drug manufacturers.

Employer Contribution

While the average cost of insurance per employees in 2019 was $599/mo, that doesn’t mean the employer is responsible for paying that entire amount.

During the process of securing benefits, employers will make a determination on how much they’d like to contribute towards the employees’ monthly premium.

While most states require employers to cover at least 50% of the premium, the final decision is up to the employers.

An average of 71% of the premiums for families and 83% for single employees were covered by employers in 2019.

Employer Contributions |

|

|

|

Family Coverage (71%) |

Single Coverage (83%) |

How much does self-funded/level-funded health insurance cost?

Self-funded (and level-funded) health insurance have both predictable, fixed costs as well as unpredictable, variable costs.

Self-funded (and level-funded) health insurance have both predictable, fixed costs as well as unpredictable, variable costs.

The fixed costs that come with a self-funding option include administration fees and stop-loss insurance. The cost of these items will vary depending on the partners selected to handle each task, but their costs for the year will be predictable.

The largest factor in determining the cost for self-funded insurance will be the annual claims total from the employees—the total of the employees’ health care spend over the course of the previous year.

- TPA fees: TPA fees will vary greatly depending on the services performed as well as which partner is selected. Additionally, how they structure their pricing will vary. Some TPAs will charge a flat overall rate for administration while other companies will charge a price per employee participating in the plan. The fee can also vary if employee benefit services are offered by various TPA branches or outsourced to specialists.

- Stop-loss insurance: According to Aegis Risk, the average cost for stop-loss insurance premiums in 2019 ranged from around $25/mo to $142/mo depending on the desired deductible.

- Variable Claims: The total sum of healthcare cost from all the employees in a given year will greatly vary depending on the health and well-being of the employees.

How much does an HRA cost?

The primary cost associated with offering an HRA as a health benefit is the predetermined reimbursement rates established by the employer.

Additionally, there could be setup fees and on-going administration fees if the employer decides to outsource the administration to another company.

If an employer chooses to self-administer their HRA there will be no administration fees, but there will typically be fees associated with producing the initial plan document for the IRS.

Take Command offers HRAs with no set up fees or long term contracts. Plan documents are always included at no additional cost.

- Reimbursement rates: When initially designing an HRA, employers will determine how much money they’d like to offer as a reimbursement, and depending on which HRA is chosen (QSEHRA or ICHRA) this amount can range widely because some HRAs have maximum contribution limits (QSEHRA) while others do not (ICHRA).

- Admin fees: Each HRA administrator will handle pricing differently, but in general there will probably be initial setup costs which oftentimes includes the production of the plan documents for the IRS as well as the initial work the administrator must perform designing the HRA and onboarding the employees. Employers can also expect an ongoing monthly fee for administration—which typically is based on the number of employees of the company.

- Plan Document fees: If an employer does not engage with a third party to administer the HRA, they will be responsible for producing the IRS required plan documents. It is highly recommended to work with a professional—lawyer or CPA, for example—when producing the official plan documents to ensure accuracy and compliance. The associated costs here are based exclusively on the rates set by the professional.

HRA Administrators vary widely from CPAs offering bare minimum services on the side to benefits companies offering HRAs as one of many options to HRA administrators exclusively specializing in HRA management.

Join the future of health benefits. Get started today.

Each healthcare option requires compliance with certain regulations both at the state and federal level.

Listed below is a good, high-level understanding of the legal requirements associated with each health insurance options.

However, this is not a comprehensive overview and does not address the varying nuances of each employer’s situation—especially at the state level.

Employers should consult with a tax or benefits professional to fully understand the legal requirements for each situation.

What are the small business health insurance requirements?

The legal requirements for small business health insurance include the following:

- Employers not required to provide insurance if less than 50 employees

- All applicable state laws (check with your state)

- All applicable federal laws including:

What are the legal requirements for self-funded/level-funded health insurance?

- Self-funded/level-funded health plans are not subject to state insurance laws

- All applicable federal laws including:

Helpful Resources

What are the legal requirements for an HRA?

- HRA design must include all employees in a fair manner according to HRA regulations

- Employees purchase qualifying health insurance

- All applicable federal laws including:

- Employee Retirement Income Security Act (ERISA) (ICHRA only, not QSEHRA)

- Health Insurance Portability and Accountability Act (HIPAA)

- Consolidated Omnibus Budget Reconciliation Act (COBRA) (ICHRA only, not QSEHRA)

Best Healthcare For Small Business

The best healthcare for small business depends on a number of factors. There’s a lot that employers need to consider when choosing insurance plans for their employees. Here’s what to keep in mind when selecting small business health insurance:

- Coverage options: Make sure the plan covers essential health benefits and fits the needs of the majority of employees.

- Cost: Consider the premium prices and any potential out-of-pocket expenses for employees.

- Network of providers: Verify if the insurance network includes the medical facilities and providers your employees prefer to use.

- Provider reputation: Check the insurance company's reputation for paying claims promptly and fairly.

- Plan flexibility: Look for a plan that offers flexibility in terms of choosing deductibles, copays, and coinsurance amounts.

- Compliance with legal requirements: Ensure that the plan complies with all state and federal regulations, including the Affordable Care Act (ACA).

- Employee contributions: Decide how much you, as the employer, will pay towards the premium and how much employees will pay.

- Enrollment and administration process: Consider the ease of enrolling employees and the efficiency of the insurance company's administrative processes.

While finding affordable health insurance for small business owners can be tricky, there are guides and resources available to help employers compare their options. This guide from Take Command explores health insurance for small business owners in depth, and can be extremely helpful for those trying to navigate the modern healthcare landscape.

When choosing employee health insurance for small business, employers should consider the short and long term. Just because a plan may fit your needs today doesn’t mean it’s going to provide adequate coverage forever. Consider the ways in which your business might grow in the future and whether or not you are likely to employ significantly more or less people down the road.

How to get business insurance that works for you

Knowing where to get started with setting up business insurance can be difficult, so we recommend employers walk through these basic steps. Additionally, we put together a quick-reference comparison chart to help employers determine a benefits model that fits their situation.

- Determine annual budget

- Select a benefits model by prioritizing:

- Cost

- Simplicity

- Quality of Coverage

- Choose the benefits option based on criteria

- Select a start date

Compare health insurance options side-by-side

| Potential Cost Savings | Ease of Setup & Administration | Employee Choices/Options | |

| Small-Group | Moderate | Moderate | Low |

| Self/Level-Funded | High | Low | High |

| HRA | High | High | High |

When business owners are eligible for HRAs

Whether an owner can participate in a company's HRA depends on how you're business is set up.

- Partnerships: Partners are directly taxed, making them self-employed and not eligible for participation in either ICHRA or QSEHRA. The QSEHRA Loophole: if the partner’s spouse is a W-2 employee (and not a partner spouse) then the owner can participate in the QSEHRA as a dependent of the spouse.

- Corporations: (Including C-Corps, B-Corps, Non-Profits, and LLCs taxed as C-Corps - anything where the entity is separate from ownership.) Corporations are the easiest entity type to handle when it comes to health insurance because owners are considered employees and can benefit from the company’s QSEHRA or ICHRA. Their dependents and any W2 employees can benefit as well.

- S-Corps: An S-Corp owner that owns more than 2% of the company is considered self-employed and not an employee, therefore typically cannot participate in the HRA. However, self-employed individuals can already deduct some health insurance expenses without an HRA.

- Sole proprietors: These unincorporated businesses are owned and operated by one individual with no distinction between the business and owner. In a nutshell: The sole proprietor is not an employee and will not qualify for an HRA.

Want to learn more about HRAs?

In the event that an HRA sounds like a good alternative for your company, you can learn more by reading these resources or connect with us using the contact options below.

Intro to QSEHRA

The Qualified Small Employer HRA started it all. Watch this quick video to get an overview. Watch now.

Read QSEHRA Guide

Perfect for small employers looking for a benefits solution. Learn more with this easy-to-read guide. Read now.

Intro to ICHRA

The Individual Coverage HRA debuted in 2020. Watch this quick video to get an overview. Watch now.

Read ICHRA Guide

The super-charged HRA. We've read and distilled the official guidelines into this easy-to-read guide. Read now.

Let's talk through your HRA questions

Fill out the form below to connect with our team and see if an HRA is a good fit.

Hello! I wrote this guide because I care about helping business owners make sense of the health insurance landscape. It's a lot to take in. I know because I used to operate my own small business, and I understand the paralyzing feeling of beginning to research health care options. Now as the Director of Marketing for Take Command, I advocate for what I genuinely believe is the best available benefits solution for employers and employees alike: health reimbursement arrangements. I'm glad you're here. Please let me know if you have any questions because we're more than happy to help. We're on a mission to change the health care system!