Employee Benefits

Employee benefits are a must-have for most employers. Benefits can often boost morale and keep employees engaged with their jobs. According to a survey by The Harris Poll for Fortune, benefits can be the deciding factor in choosing between two offers.

The bottom line? Employees love benefits.

Take Command understands you want to provide your employees with great benefits.

Our North Star is leveraging technology and expertise to help employers take care of their employees.

This guide is to help employers understand why benefits are important and provide some “out-of-the-box” solutions to your company's benefits packages.

This Employee Benefits Guide was updated for 2025 with the latest and greatest.

Which HRA is right for you?

What are employee benefits?

Employee benefits are any benefit provided to the employee in addition to compensation. Basically, it’s any perk offered above and beyond a paycheck. Employee benefits are linked to many positives.

- Increases productivity

- Fosters a sense of loyalty

- Minimizes absenteeism

- Helps with recruiting efforts

- Boosts retention

As an employer, do you have to offer benefits?

Very few employee benefits are required by law and vary from state to state. This means there isn't one playbook or script to offer your employee benefits.

Latest employee benefit trends

Wondering what's shaping the employee benefits conversation? If you're researching employee benefits for your company, you'll want to keep up on the latest HR trends and the new technology that's shaping the employee benefits conversation.

Business as usual isn’t business as usual anymore.

In fact, it’s a lot more expensive.

Employer health costs for 2022 are expected to increase 6.5% for employee benefits, according to a study by PriceWaterhouseCoopers.

As the pandemic continues to play out, carriers expect increased utilization and increased healthcare spending. The halt on elective surgeries has lifted and now everyone is playing catch up. Treatment for COVID-19 has burdened the health system, as well as the related mental health care that’s spiked in the last year and a half.

All of this contributes to premium hikes but even without a pandemic, group rates have been rising year over year. Inflation has also had an effect on health insurance costs.

This upward trend is nothing new; KFF reports that the average premium for employer-sponsored family health coverage increased 22 percent over the last five years and 54 percent over the last ten years.

A recent survey of CEOs by PBGH and Kaiser Family Foundation bore that out. Almost 9 in 10 said the current system of employee benefits will be unsustainable for them within the coming 5 to 10 years.

A NFIB survey found that the cost of healthcare was small business owners’ most severe problem—those survey results have not changed since 2012.

Not only are business owners weary of spending more and more on rising health insurance premiums for employee benefits, employees are burdened with increasingly unaffordable out-of-pocket expense requirements from insurers.

While group plans used to be touted as the gold standard for health insurance, this simply isn’t the case anymore for a number of reasons.

For starters, only 54% of employers actually offer benefits, and that number is decreasing. But group plans fall short in other ways. For example, employee shares of premium payments taken out of their own paychecks continue to increase year over year as companies grapple with their budgets.

The Employer Health Benefits 2019 Summary of Findings reported that 31% of covered small business employees had their employer pay their entire premium while 35% were enrolled in a plan where more than half of the premium for family coverage came out of their paychecks.

Not only are they an expense saddled on the employees, those paying a lion-share of their own premiums are given very little choice in the matter.

74% of the time, employees are limited to one plan choice within their group plan. Most of the time, when you’re footing the bill, you get to choose what to buy.

If workers change or lose their jobs, they’re left scrambling to find coverage, settling for pricey COBRA, or having to switch from plans that include the doctors they trust.

This is hardly the consumer-friendly solution we all hope for, and it’s never been called out so clearly as it has in the past couple of years.

The pandemic has fundamentally changed the way we work.

Most notably, the wave of newly remote workers will certainly shape the future of employee benefits. The percentage of workers working full-time remote is expected to double this year, according to a study by Enterprise Technology Research.

Remote work has changed the dynamics of the workforce in more ways than one.

Another survey noted that over 74% of businesses plan to permanently shift employees to remote work after the COVID-19 pandemic ends. For those employers administering group plans, having workers in more than one location can be quite the challenge; traditionally, it’s very difficult to keep part-time and remote workers on group plans.

Wondering how you could design your HRA?

Benefits required by law:

- Employer must provide employees time off to vote, serve on a jury, or service in the military

- Pay state and federal unemployment taxes

- Comply with the Federal Family and Medical Leave Act (FMLA)

- Comply with states workers' compensation requirements

- Contribute to state short-term disability programs (California, Hawaii, New Jersey, New York, and Rhode Island)

Now, benefits that are NOT required by law:

- Health Plans (except in Hawaii and for employers with more than 50 employees)

- Retirement Plans

- Dental/Vision Plans

- Life Insurance Plans

- Paid vacations, holidays, or sick leave

- Fringe Benefits (we'll talk more about these below)

Do small business have to offer benefits?

The Affordable Care Act states that small businesses with fewer than 50 employees do not have to offer health insurance benefits (or any benefits, for that matter) and will not be subject to a tax penalty. But there are plenty of great reasons to considering offering benefits, even if you aren't required to.

Small businesses should offer employee benefits for a few reasons:

Small business benefits help small businesses attract and maintain talent in the midst of steep competition and unforeseen resignation. It also means simply taking care of your employees; benefits help them stay healthy, happy and productive!

And for some benefits, you can count on saving money during tax season by taking care of your employees.

Why are employee benefits important?

The Great Resignation served as a wake-up call for millions of employers. According to the Boston Globe, approximately 3.9 million American workers left their jobs in June 2021. Recruitment efforts are equally challenging; 47% of job candidates declined job offers because they accepted an offer elsewhere (presumably with better compensation and benefits).

As economic conditions change, data still shows many workers are burned out. Better workplace benefits are often a leading factor in why employees take on a new position.

One of the main reasons that employee retentions strategies are so important is that it costs more to recruit, hire, and train new employees than it does to retain quality employees.

In fact, studies show that even an $8 an hour employee can cost a company $3,500 in direct and indirect recruiting and training costs.

What's more, when the time does come to hire new employees, a high rate of retention is appealing to them; long-time employees means you must be doing something right!

A whopping 92% of employees say benefits are important to their overall job satisfaction, according to a report by the Society of Human Resource Management.

But retention is important, too! It goes without saying that your business cannot thrive without your most trusted and valuable employees. That's why using employee benefits to promote job satisfaction is critical to your business.

According to the Society for Human Resource Management, there are some tried and true strategies that can be applied to your company culture that.

- employees want to be treated well and fairly, no matter what level of the company they work in - be an employer who listens well!

- employees value trust between themselves and senior management

- employees want to know their job is secure

- employees want to feel they are using their skills and abilities - make it a point to regularly recognize employees and their achievements!

- employees value compensation, and health benefits rank right up there with a paycheck

The good news, many of these work perks can be cost-friendly.

Popular Types of Employee Benefits

Health Plans

Healthcare is a key benefit for many employees. Health plans can come in a few different ways. Some examples include traditional group insurance, Health Reimbursement Arrangements (HRAs), vision/dental insurance, or an employee assistance program.

Retirement Plans

Financial security allows employees to plan for their future. By providing a retirement plan, you are ensuring their future success. Plans can come in the form of pensions, 401ks, and many more options.

Fringe Benefits

What are fringe benefits? Fringe benefits are often seen as non-traditional benefits. But as the labor market gets tighter, these non-traditional benefits may be the thing that sets employers apart.

In the Harris Poll Survey, millennials cited a flexible schedule as one of the top benefits they are looking for in an employer. These types of benefits can be affordable and may have a tax benefit.

Unlock tax advantages with an HRA. Find out more today.

Fringe Benefits

Health & Wellness

By promoting healthy lifestyles for employees and their families, you are helping them lead happier lives.

- Fitness Reimbursements

- Discount Card Programs (Fresh Bennies)

- Telehealth (Teledocs, etc.)

- Mental Health Assistance (Better Help, Etc.)

- Headspace/Calm Subscription

- Wellness Challenges (Steps challenge, walkathon, healthy cooking class, Etc.)

Gary was diagnosed with pre-diabetes. Afraid of his health, Gary decided to make some lifestyle changes. He took advantage of his employee’s Fitness Reimbursement program and got a membership to a local gym. Through exercise and nutrition coaching, Gary lost 50 pounds and lowered his blood sugar levels to a normal range.

I feel better than ever! Not only did I lose weight and get my body in shape, my anxiety is gone too. I feel both physically and mentally strong.

- Gary

Sharice noticed she was more anxious than normal and was feeling overwhelmed. She knew she needed help. Her employer offered therapy through an online service. Sharice was able to see a therapist on her schedule and be matched quickly. Therapy has helped her manage stress and new ways to cope with her anxiety.

I always thought therapy was too expensive and the wait for an appointment was too long. I’m so glad I was able to connect with a therapist quickly. I’m more centered and prepared for life’s challenges.

- Sharice

Work Solutions

On-the-job benefits can keep employees engaged and motivated. By offering workplace benefits, employers have the opportunity to feel connected and rejuvenated.

- Professional Development

- Cellphone Plan

- Remote Work Credit

- Food Delivery Credits

- Manicures/Massage

- Bring Your Dog to Work

- Nap Pods

- Snack Bar

- New Hire Welcome Package

- Sign-On Bonus

- Home Office Improvement Incentives for Remote Workers

- Casual Dress Codes

- Flexible Work Schedules

- Performance Bonus

- Stock Options

- Leadership Coaching

- Paid Time-off

When Theresa's youngest child wouldn't sleep through the night, she was left exhausted and frustrated. At work, her job created space for nap pods. They weren't the high-tech Google nap pods but a private space with a recliner and couch. Theresa was able to take a short nap while on the clock. After rest, she felt more motivated to finish her work day.

Our nap pods allowed me to get the rest I needed so I could stay motivated on the clock. Sometimes, it’s important to take a step back.

- Theresa

Joe just started a new job that allows him to work from home. His new employer has a home office improvement incentive that allowed him to set up a comfortable space inside his house.

I finally have my dream workspace. I feel comfortable and more productive.

- Joe

Life Solutions

Life happens. Help employees manage their home life with life solution-based benefits.

- Back-Up Daycare Credit

- Tutoring Discounts

- Corporate Discounts

- Unlimited Vacation

- Tuition Reimbursement

- Debt Repayment

- Doggy Daycare

- Pet Savings

- Prepaid Legal Service

- Identity Theft Protection

- Financial Counseling + Financial Planning Resources

- Event and Concert Tickets

- Life Insurance

- Short-term Disability

- Long-term Disability

Emily was the first person in her family to go to college. But during her second year, she had to leave to get a full-time job. With her company's tuition reimbursement program, she could return to school part-time to complete her business degree.

I never thought I would be able to afford to go back to college. My job helped me realize my dream and my family is so proud of me.

- Emily

Throughout most of Amelia’s career, she only had a couple weeks of vacation. It was usually used for family obligations and short travel. When her company switched to unlimited vacation days, Amelia was able to plan her dream vacation overseas.

I never thought I would have enough vacation days to go on a long vacation. I was able to see 4 different countries.

- Amelia

How much do employee benefits cost?

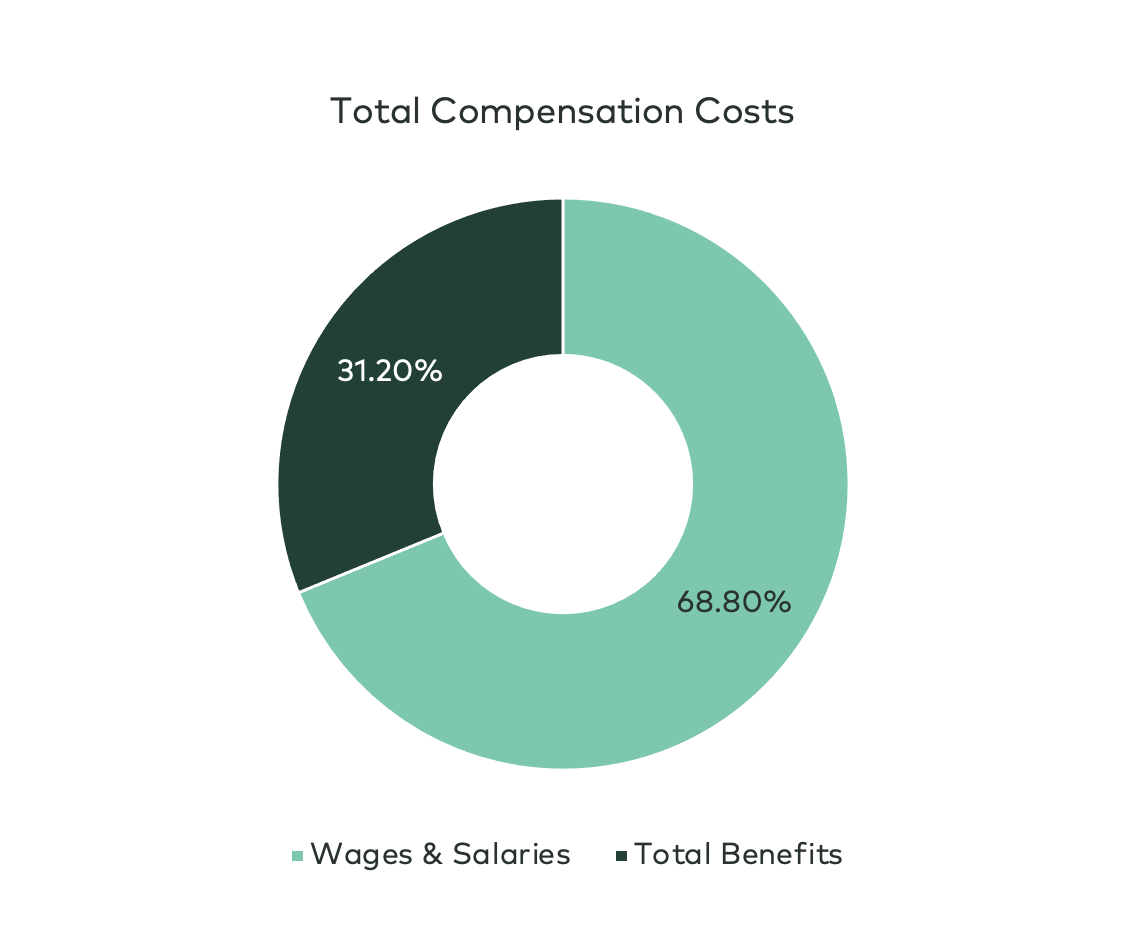

Most employee benefits come at a cost. According to the U.S. Bureau of Labor Statistics, employee benefits are about 30% of total employee compensation costs. It’s important to understand the tax benefits of offering employee benefits. Even some fringe benefits are outlined by the IRS.

How do I calculate the cost of employer-sponsored health benefits for my company?

Offering health benefits to your staff can come with some significant expenses and the dollars can add up quickly. However, to recruit and retain employees, employer-sponsored health benefits may just be the cost of doing business for employers - even if not required to by the ACA (Affordable Care Act).

When calculating the costs of employer-sponsored health benefits, you’ll want to consider several areas of cost. The costs associated with offering employee benefits extend beyond the premium costs. There are costs and work hours associated with setting-up benefits, maintaining, and administering them.

It’s also important to remember that depending on the plan you choose for your employees, those costs may increase year over year. According McKinsey & Company, employers could face health cost increases of 9 to 10% through 2026 because of inflationary pressure passed through from providers. That’s about a 4% increased compared the previous 5 years. The average costs associated with benefits have averaged a 5-7% hike year over year.

The costs of health benefits will depend on a couple variables: the size of your business and the type of plan you choose and what is covered. Let’s take a look at some data that helps you understand the cost per employee. The U.S. Bureau of Labor Statistics estimates the total employer compensation costs for civilian workers average at $41.86 per hour working in September 2022.

Wages and salaries account for 69% of the hourly wage leaving the remaining 31% at $12.98. It’s important to note that remaining costs include health benefits in addition to other benefits.

However, health insurance is typically the most expensive cost when it comes to benefits. The Kaiser Family Foundation says the average cost of employee health insurance premiums for family coverage was $22,221 and self-only was $7,739 annually in 2021.

How to choose which employee benefits to offer?

With so many benefit options, it’s hard to choose. The best place to start is to align with your company goals. Understand what you what from your company and what type of employer you want to be. The next step would be to understand the needs of your employees. Understanding how to engage your employees is key to driving effective change.

Streamline your benefits management. Switch to a hassle-free HRA plan!

In today’s workforce, millennials (ages 25-40) make up 35% and by 2030 that number jumps to 75%.

When deciding what benefits to offer, it’s important to understand how this generation works. Millennials are adventure seeking, tech savvy, and highly educated.

In several studies, millennials rank work-life balance at the top of their list for employee satisfaction. Work-life balance can have different meanings for different people. But

- Flexible Schedule

- Remote Work

- Unlimited Vacation/Time-off

- Dedicated Mental Health Days

While Millennials are looking for more balance, they’re also incredibility motived. This generation strives for growth and learning opportunities both professionally and outside of work.

A Deloitte survey ranked professional growth and learning as a top reasons they chose to work for their current employer.

They also cited purpose meaning Millennials are looking for a higher meaning.

- Professional Development

- Learning Budget

- Support for Employee’s Volunteer Work

Remember, when we said Millennials are highly-educated? Well, that comes at a cost. 35% of young Americans say student loans impact how they buy daily necessitates. In addition to a higher salary, Millennials are looking for financial benefits that help them get out of debt.

- Student Loan Repayment Programs

- Performance Bonuses

- Sign-On Bonus

- Home Office Improvement Incentives for Remote Workers

- Cellphone Plan

How to manage your employee benefits

Benefits administration can be a time-consuming task. To efficiently and minimize headaches, here are a few tips.

- Partner with a benefits administrator like Take Command for HRA benefits

- Hire a benefits specialist

- Communicate changes and benefit details to employees

- Get employee feedback

What about health insurance for part time employees?

You also may be wondering about part time employees. Employers have no legal obligation to offer health benefits to part-time employees. However, if an employer chooses to offer health benefits to part-time employees, they have to offer to all part-time employees.

The federal government requires fairness when offering health benefits to prevent discrimination. To differentiate employees, employers must used job-based criteria like employment status (full-time vs. part-time) or geographical locations (different states) to determine what benefits to offer where.

This applies to small business owners or those with less than 50 full-time employees. Small businesses are not legally obligated to offer health insurance but if they do they must adhere to the same standards of determining benefits by job-based criteria.

For health benefits, find an HRA administrator that does all the heavy lifting for you, including onboarding employees, reporting, and keeping you compliant. Watch our HRA administration platform demo here!

How to get started offering benefits

It’s important to weigh your options and cost vs. benefits. Speak with your benefits broker to help you decide what benefits fit your employees’ needs.

Here are a few things to think about when getting started:

- What is your budget?

- What is your timeline for rolling out benefits?

- What type of benefits would be the best fit for your company and your employees' needs?

How much do employers pay for health insurance?

Health insurance is costly no matter what your choice is. As an employer, it can be even more so. Many employers are being forced to look at other ways to supply health benefits due to the rise in the cost of living, the rise of inflation, and the Great Resignation.

The cost for employers contributing to health insurance has increased 368% over the last 14 years.

In general, employers pay for 83% of single coverage employee health insurance plans and 73% for family coverage on average. In other words, employer-sponsored health insurance costs provided by the Employer were $7,470 for single coverage and $21,342 for family coverage.

If it's so expensive, why do employers offer this benefit?

Great question.

Companies do NOT have to offer health insurance as a part of their benefit package, but many do for the following reasons: Helps hire and retain the best workers, feel they have the responsibility to provide this, encourages productivity, know their employees cannot afford it on their own, and lastly, the tax benefits.

How do you calculate employee benefits?

Calculating employee benefits has a specific formula. This is done by taking the total annual amount spent by the company on benefits and dividing it by the total annual amount spent on salary.

Hands down, health insurance is the most expensive benefit that employers offer.

There is a lot more behind the scenes than meets the eye for the Employer when selecting benefits. They need to review what they have and if employees will use it, budget, and whether their employees want the benefit. Employers will often contemplate what their employees want and need to make sure they are able to meet those expectations. They take these measures to minimize the risk of failure.

What are the best employer insurance plans?

The best employer insurance plans are going to offer Medical, Dental and Vision benefits. Employers need to pick a plan with a healthy preventative care plan (also known as a qualified health plan or one that meets minimum essential overage) with little or no charge. They also need to pay as much as the employees' premium as possible. Other options for plans would include Mental Health benefits and life insurance.

Shopping as an employer in comparison as an individual has several things in common. Selecting a policy with low deductibles and minimal to zero copays is the goal. Obviously, you want to have good benefits before meeting a deductible and making the insurance plan work for your budget.

What are the health insurance employer contribution rules?

The Affordable Care Act (ACA) does not specify a set amount that employers must contribute, although some insurance carriers or states require employers to cover at least 50 percent of the premium for employee-only coverage. This rule is meant to persuade more employees to join the health plan in an attempt to prevent only those prone to sickness in signing up in turn causing a high-risk group to the insurer.

More and more, traditional group health plans are shifting more of the financial burden to employees, either with a high deductible or high employee contribution coming out of their paychecks.

This is a challenge that HRAs like QSEHRA and ICHRA solve for. There are affordability rules in place to ensure that employee contributions to health insurance are affordable for the employees. According to our own research, the majority of our HRA clients are covering a larger portion of the lowest cost silver plan for employees than the national average employer contribution, meaning HRAs are helping employees afford health insurance.

What are the key employer requirements and regulations surrounding employee benefits?

Depending on the size of your business, there may be certain regulations or requirements that you must abide by when offering health insurance to your staff. If you’re an employer with 50 or more full-time employees, you must offer affordable medical coverage to their full-time employees and their dependents. Dependents include children up to age 26. The legislation doesn’t require employers to offer coverage to spouses.

You may have noticed the word “affordable” in the previous paragraph. Employers have a lot of questions around what that means. Coverage is defined as affordable if the employee’s coverage doesn’t exceed a certain percentage of an employee’s household income. The percentage adjusts annually for inflation.

For 2024, the IRS set the percentage at 8.39%. It’s important to note that affordability is based on the cost of the self-coverage available to the employee. This doesn’t take into consideration the added premiums of dependents. This is what’s called the family glitch.

For example, if the employer pays the for employees health care coverage but doesn’t contribute to premium of the added family members, the plan is still considered affordable even if the added family members cost exceed the percentage.

Are there employer health insurance requirements?

The provisions of the Affordable Care Act (ACA) decide whether an employer must offer health insurance or not.

In most states, small businesses with fewer than 50 full-time employees have no legal requirement to offer health insurance.

Health insurance coverage must be offered to all full-time employees, meaning those that work 30 hours or more per week.

Small businesses do not have to extend the offer of health insurance to part-time employees (under 30 hours a week). Although, if an employer offers the health insurance to one part time employee, then the employer must offer it to all part time employees.

Employers also do not have to contribute to paying the premiums for dependents. Some employers do this but are under no obligation.

Employers' decision to offer health insurance as a part of their benefit package is a hard and expensive decision. It can equally be just as rewarding to offer HRA plans as well. It comes down to truthfully how Employers can save money but also supply the care their employees need the most.

Disclaimer: We’re licensed health insurance agents, HRA plan administrators, and experienced HRA practitioners, but we are not licensed tax professionals—please don’t treat our advice as such. Practical knowledge and links to relevant IRS regulations and legal resources are provided throughout this guide.

This guide was originally published in 2022 and has been updated for 2025.

Fill out the form below to connect with our team and see if an HRA is a good fit.

With 15 years in the communications field, Briana is a content writer with a passion for making complex issues readable, understandable, and digestible. Her career is layered with experience working with Fortune 100 companies, non-profits, and start-ups. She specializes in employee benefit communication.

Briana is a married mother of two young girls in the Midwest. She loves yoga, volleyball, and reading by the pool.