What can be reimbursed with QSEHRA?

Official QSEHRA Reimbursement Guide

If your employer is offering you QSEHRA reimbursements this year, congratulations! QSEHRA is a new, tax-efficient way for small employers to reimburse employees for health insurance and medical expenses. Get excited too—you’ll find you have much greater flexibility on how to spend your benefit dollars to fit your needs rather than a one-size-fits-all group plan or worse yet, nothing at all.

The goal of this guide is to help you understand all of the things that can be reimbursed by a QSEHRA.

We wrote this guide to help you get the most from your QSEHRA reimbursements. We’ll share:

- Requirements for Reimbursement

- Answer taxability questions

- Explore different types of health plans and premiums that work with QSEHRA

- Share what medical expenses can be reimbursed

- Explain how to use your QSEHRA for over-the-counter drugs

- Answer Frequently Asked Questions (FAQ)

Note: The advice in this guide should not be construed as official tax advice. We are licensed health professionals and experienced QSEHRA practitioners, but every situation is different. We strive to provide helpful links to IRS and QSEHRA legislation to help keep you safely within the guidelines.

Which HRA is right for you?

QSEHRA Reimbursement Requirements

What’s required to receive QSEHRA reimbursements?

Even though QSEHRA was brand-new in 2017, regulations governing health plans have changed significantly since then and IRS guidance has not yet caught up. You’re likely to see conflicting guidance if you search around the internet—some stuff is just out-of-date (“HRA” guidance before QSEHRA) and some of it is just wrong. We’ll do our best here to keep things up to date and will provide as many references and links to authoritative sources as we can.

QSEHRA eligibility

Here’s what is certain: You must be covered by Minimum Essential Coverage (MEC) to receive QSEHRA reimbursements. We’ll show you which plans include MEC or how to get MEC in the “Health Plans & Premiums” section below. However, for you detailed folks, MEC is defined by IRS Section 5000A(f) and the requirement to maintain it for QSEHRA is clearly spelled out in IRS Notice 2017-67, Section G. We’ve seen some employers, employees, and even some of our competitors play fast and loose with this. However, we think this can only come back to bite you. Your QSEHRA could fall apart and your employer could be hit with fines up to $100 per day per person if audited, yikes! (see Section L and IRS Section 4980D).

What happens if I don’t have MEC or I lose my MEC coverage?

Before you can ever receive a QSEHRA reimbursement, you must substantiate that you have MEC (IRS Section 9831(d)(2)(B)(ii) and IRS Notice 2017-67, Section G and Q72). This typically means providing your QSEHRA administrator with a copy of your health insurance card or other information. If you’re a Take Command member, we’ll ask you to take a photo of your card or a medical receipt to upload it online.

Once you get started, if you lose your MEC coverage for some reason, the QSEHRA reimbursements received during the time you did not have MEC will be considered taxable and you may have to pay them back (IRS Notice 2017-67 Q45 and Q62). Employers are required to stop payments immediately once they become aware an employee is not maintaining MEC or the QSEHRA itself could fall apart.

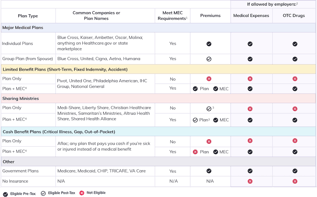

The MEC issue can be a little confusing. Make sure to check out our handy chart in the next section that breaks it down for you by plan type. If you need help, you can always contact us below!

Unlock tax advantages with an HRA. Find out more today.

If Take Command manages your QSEHRA, we will automatically apply pre-tax balances to your account first (to help you maximize your tax savings) and then apply any remaining balance to post-tax reimbursements (hey, it still helps!).

What types of health plans work with QSEHRA?

The great thing about QSEHRA is if you already have a health plan you love, you can probably keep it! If you need to shop for a new one, you’ll find a world of new options. Don’t worry if it feels overwhelming, we can help!

Different plan types will be treated differently under QSEHRA. You’ll want to be aware of these nuances to make sure you’re getting the most cost and tax-efficient results. Below, we’ll provide more explanation for each plan type.

Here’s a summary table to help! You can download the table as a PDF too if you'd like.

Permitted benefits under a QSEHRA

- QSEHRA participants must maintain Minimum Essential Coverage (MEC) to receive reimbursements (IRS Notice 2017-67, Section G).

- Employers can specify whether or not to include these reimbursements under their QSEHRA rules.

- Sharing Ministries may be reimbursed post-tax outside of the QSEHRA if elected by the employer.

- Learn more about using individual MEC products to meet the MEC requirements.

Major Medical Plans

When we talk about “Major Medical” plans, we’re talking about health plans that are compliant with the Affordable Care Act (ACA). Think plans from Blue Cross, Molina, Oscar, Ambetter or other regional companies if you’re on an individual plan or United, Cigna, Aetna, etc. if you’re on your spouse’s group plan from work. Major Medical plans must:

- Insure individuals with pre-existing conditions

- Pay for preventive care at no extra cost

- Have unlimited annual and lifetime benefit levels

Because they provide all of these guaranteed benefits, Major Medical plans are typically the most expensive and only available for enrollment once per year during an Open Enrollment period (unless, of course, you have a Special Enrollment reason). If you purchased a health plan from Healthcare.gov or your state’s public marketplace, you purchased a Major Medical plan. If you get insurance from your spouse’s employer, you most likely have a Major Medical plan.

Still not sure if you have a Major Medical plan or not? Most states require insurance companies to disclose if they are not a Major Medical plan. Look for fine print that talks about exclusions, or, you can always chat with us to ask! Another giveaway—Major Medical plans must provide individuals with a 1095 each year to file with their taxes to satisfy the ACA’s individual mandate to maintain Major Medical insurance (even though that mandate is slated to go away in 2019).

The QSEHRA laws were written with Major Medical plans in mind. All premiums for individual Major Medical plans meet the MEC requirements and are considered eligible for reimbursement on a pre-tax basis.

If you’re covered by your spouse’s group plan there are some nuances to know regarding premium reimbursement:

- First, verify whether your employer has elected to include spouse group plans in the QSEHRA. Many will, but some won’t if they are trying to aggressively contain costs.

- Next, only the portion of the group premium that is not paid for by your spouse’s company is eligible for reimbursement. For example, let’s say your spouse’s plan costs $1,000/mo total. Your spouse’s company kicks in $400/mo to help cover the cost. Only the remaining $600 would be eligible for QSEHRA reimbursement (if allowed by the employer, see step 1 above).

- Finally, most group plans are already paid on a pre-tax basis on your spouse’s paycheck. In the example above, even though you’re paying $600/mo to cover the difference, your spouse is likely able to pay for it pre-tax on his or her paycheck. This is great! However, the IRS doesn’t want you to “double dip” and also get a pre-tax QSEHRA reimbursement. As a result, your QSEHRA claim will likely be paid on a taxable basis unless you can show the premiums were paid post-tax by your spouse (very rare). See IRS Notice 2017-67 Q48 if you’d like to dive into the weeds!

Limited Benefit Plans

Limited Benefit Plans are growing in popularity as the federal government eases regulations around them. Limited Benefit Plans do not meet the ACA’s individual mandate for everyone to have health insurance. Limited Benefit Plans are usually significantly cheaper than Major Medical plans but only provide a fixed amount of benefits (vs. unlimited benefits). Those benefits could provide great coverage, or they could be pure snake oil—the devil is in the details and fine print. Most limited plans require some level of medical underwriting and will not cover pre-existing conditions.

At Take Command, we offer a curated offering of Limited Benefit Plans to make sure our clients are getting sufficient coverage. Always, always, always….always purchase Limited Benefit Plans that have continuous coverage until the end of the calendar year—that way if you develop a condition, you can flip to a Major Medical plan during the annual open enrollment period.

Popular Limited Benefit Plans you may be familiar with are Short-Term Plans, Fixed Indemnity, and Accident Plans. Common insurance companies that underwrite these plans are UnitedHealth One, Pivot, Philadelphia American, IHC Group, and National General among others.

On their own, Limited Benefit Plans do not meet the MEC requirement to receive QSEHRA reimbursement. That stinks. However, there is hope! If you can gain access to a MEC plan through your spouse or by purchasing an individual MEC plan, then the premiums for both the MEC and the Limited Benefit Plan are reimbursable tax-free under the QSEHRA.

The commonality between the Limited Benefit Plan types we described above is they must provide a medical benefit, not a cash benefit (we call those “Cash Benefit Plans”, and we talk about them later). The difference is nuanced but important according to IRS Publication 502 which in part governs reimbursable expenses for QSEHRA. Insurance plans that pay a medical benefit are reimbursable (see page 8) while insurance plans that pay a cash benefit are not reimbursable (see page 9).

Wondering how you could design your HRA?

A Limited Benefit Plan that pays a medical benefit will say something like “we will pay up to $1,000 a day in hospitalization benefits if you’re sick or injured”. A Cash Benefit Plan will say “we will pay you $1,000 if you get sick or injured.” One pays a doctor or hospital, one pays you cash. Subtle for sure, but important to know for QSEHRA!

To summarize: A Limited Benefit Plan alone does not work under QSEHRA. However, if you can satisfy the MEC requirement, then the Limited Benefit Plan premium is reimbursable along with Medical Expenses if allowed by the QSEHRA’s plan design.

Cash Benefit Plans

Cash Benefit Plans pay you cash if you’re sick or injured. These plans are sometimes called Critical Illness, Gap, or Out-of-Pocket plans. The most popular insurance company that writes these plans is Aflac (quack!). We rarely recommend these plans. If you read the fine print and do the math, they just typically are not a good deal for individuals and small employers. (Now, if your big company is paying for it for you…that’s a different story).

Similar to the Limited Benefit Plans above, Cash Benefit Plans by themselves do not meet the MEC requirement and are not eligible for QSEHRA reimbursement. Even if you gain access to MEC through a spouse, by purchasing an individual MEC plan, or through some other means, the Cash Benefit Plan premium will still not be eligible for reimbursement. That’s because these plans by definition do not provide a medical benefit. In IRS Publication 502, these plans fall under “Insurance Plans You Can’t Include” on page 9.

For an example of the difference between medical and cash benefits, see the previous section on “Limited Benefit Plans.”

Although the individual MEC option won’t work with Cash Benefit Plans, the MEC may still be worth it so that your Medical Expenses and OTC Drugs are reimbursable if allowed by the QSERHA’s plan design.

Sharing Ministries

Healthcare Sharing Ministries are exploding in popularity due to their lower costs and the shared values they promote. Popular Sharing Ministries include Medi-Share, Liberty Share, Christian Healthcare Ministries, Aliera, Samaritan’s Ministries, Altrua Health Share, and Shared Health Alliance among others.

The IRS has not provided much guidance on how Sharing Ministries work with QSEHRA and they really need to.

Sharing Ministry members have a special exemption under the Affordable Care Act from maintaining MEC; however, Sharing Ministries themselves do not meet the MEC requirements. We explored this circular reference in detail in this blog post.

To further complicate matters, the “premiums” you pay to be a member of a Sharing Ministry, typically referred to as a “monthly share” amount or similar, are not recognized by the IRS as being actual insurance premiums under IRS Section 213(D).

While there hasn’t been any clear guidance and it’s ultimately up to you and your tax professional, our suggestion for now is to not consider Sharing Ministries as meeting the MEC requirements and therefore not consider their monthly “premiums” as eligible for reimbursement under the QSEHRA.

But please don’t despair, there’s hope! Because Sharing Ministries are technically not insurance, they can be reimbursed on a taxable basis outside of the QSEHRA if employers want to allow it. This type of after-tax reimbursement outside of a QSEHRA is not possible for Major Medical or Limited Benefit Plans that are recognized as insurance in the eyes of the IRS because that reimbursement would constitute and Employer Payment Plan (EPP) which is subject to all sorts of group plan regulations and penalties. See this IRS guidance on “Employer Health Care Arrangements” and IRS Notice 2013-54.

But please don’t despair, there’s hope! Because Sharing Ministries are technically not insurance, they can be reimbursed on a taxable basis outside of the QSEHRA if employers want to allow it. This type of after-tax reimbursement outside of a QSEHRA is not possible for Major Medical or Limited Benefit Plans that are recognized as insurance in the eyes of the IRS because that reimbursement would constitute and Employer Payment Plan (EPP) which is subject to all sorts of group plan regulations and penalties. See this IRS guidance on “Employer Health Care Arrangements” and IRS Notice 2013-54.

On the Take Command QSEHRA Platform, we can help employers and employees track Sharing Ministry reimbursements alongside QSEHRA reimbursements for a cohesive experience. Employers have the option to turn on or off Sharing Ministry reimbursements.

Finally, while we do not suggest Sharing Ministries be allowed to meet the MEC requirement on their own, you can satisfy the MEC requirement by spousal coverage or by purchasing an individual MEC. In this case, the cost of the MEC would be reimbursable tax-free under the QSERHA. If MEC is in place, then Medical Expenses and OTC drugs could be reimbursed under the QSEHRA as well if allowed by the QSEHRA’s terms. The monthly “premiums” or share amounts for the Sharing Ministry would be reimbursable on a taxable basis outside of the QSEHRA if allowed by the employer.

Other Coverage Types

There are other, less common types of health plans that meet the MEC requirements and work great with QSEHRA. These include:

- Medicare, including Medicare Supplements and Medicare Advantage (Medicare Part A meets the MEC requirement, other Parts are then eligible for reimbursement under QSEHRA)

- Medicaid

- CHIP

- TRICARE

- VA Care

- Certain Grandfathered health plans

For a complete list of plans that meet the MEC requirements, see IRS Section 5000A(f). The Centers for Medicare and Medicaid Services (CMS) also maintains an up-to-date list of qualified MEC plans that is a little easier to read than IRS guidelines.

Uninsured

Are you going without insurance at all? While we don’t recommend this approach, we get it. Insurance has gotten extremely expensive. However, with more alternatives emerging and all the plan types we described above, many of which are very inexpensive, we highly recommend you look into some sort of coverage. We can help you if you’d like!

However, if you plan to go uninsured, then you won’t be able to derive much benefit from QSEHRA. You won’t meet the MEC requirement and therefore you cannot receive any QSEHRA reimbursement.

If I don’t have any insurance, can I still get QSEHRA reimbursements?

Something we get asked often: Even if I don’t have insurance, can I just get reimbursed for my medical expenses? Unfortunately, the answer is a clear “no” from the IRS. Question 72 in the latest IRS Guidance (Notice 2017-67) clearly identifies reimbursing “medical expenses without first requiring proof of MEC” as a condition that would cause the QSEHRA to fail, subjecting the employer and employees to potential penalties. If your employer offers reimbursement for medical expenses outside of a QSEHRA, they’ll likely be subject to Employer Payment Plan (EPP) regulations which can result in big fines and penalties (see Q1 on the IRS “Employer Health Care Arrangement” guidance and IRS Notice 2013-54).

If you’re being offered a QSEHRA reimbursement, you should at least consider picking up an individual MEC plan. The MEC’s premium will likely be covered by the QSEHRA reimbursement so there will be no cost to you and now you can get other medical expenses reimbursed! (if allowed by your employer)

What medical expenses can be reimbursed with QSEHRA?

The really cool thing about QSEHRA is that it’s the only vehicle that can reimburse insurance premiums and medical expenses. FSAs and HSAs can't do that! That’s awesome! It’s a great benefit because you have a ton of flexibility on how you want to spend it.

Two things must be in place before you can claim medical expense reimbursements:

- Your employer must have elected to allow medical expense reimbursement in the QSEHRA terms;

- You must meet the MEC requirements (see the section above!).

If you meet the above, you’re good to go!

QSEHRA Eligible Expenses

If you have MEC and your QSEHRA’s terms allow for medical expense reimbursement, you’re in good shape! The allowable list of medical expenses is very broad and comprehensive. “Medical care” is defined by the IRS in Section 213(d) and a summary of expenses can be found in IRS Publication 502. To keep things practical for the purposes of this guide, here’s a handy list:

- Doctor visits (including co-pays, coinsurance, and payments before your deductible)

- Hospital bills

- Prescription drugs

- Eye glasses

- Dental treatments

- Glasses and contacts

- Diagnostic tests and labs

- Chiropractor

- Lasik Surgery

- Hearing aids

- Nursing services

- Physical therapy

- Counseling

Join the future of health benefits. Get started today.

Have you used a Health Savings Account (HSA) or Flexible Spending Account (FSA) before? It’s the same list that governs QSEHRA (plus insurance premiums, of course). Check-out online sites like FSAStore.com to see which household products are eligible for QSEHRA (note: some items on sites like FSA store require a prescription or doctors note).

What aren't considered QSEHRA qualified expenses?

Ok, so not everything is eligible. In general, things that may be medically-related but not medically-necessary are not eligible for reimbursement. Here’s an example of a few items we are commonly asked about that are not eligible:

- Babysitting

- Cosmetic surgery

- Diapers

- Gym memberships

- Teeth whitening

One other key point on medical expenses – if you have a Health Savings Account (HSA) or other reimbursement account, you can continue to use it, but you can’t use a QSEHRA to fund it. If you have a medical expense, say a $100 doctor bill, you can choose to use either your HSA or your QSEHRA to cover it pre-tax. The IRS frowns on “double-dipping” if that makes sense.

A good rule of thumb to determine if an expense is eligible or not is to ask, “Is this medically necessary or beneficial?” Doctor visits and dental cleanings = Yes. Cosmetic surgery = No. Also, you can always ask us and we can help!

What about medications without a prescription?

Well, more good news! You can use your QSEHRA to help pay for over-the-counter (OTC) drugs without a prescription. The 2020 CARES Act, passed in response to the Covid-19 pandemic, made over-the-counter medicines and female menstruation products eligible for tax-free reimbursement.

The same two requirements for medical expenses described above apply to OTC drug reimbursement:

- Your employer must have elected to allow for medical expense reimbursement through your QSEHRA.

- You must meet the MEC requirements.

Common examples of OTC drugs include:

- Tylenol

- Advil

- Motrin

- Halls

- Robitussin

- Sudafed

- Afrin

- Benadryl

- Allegra

- Zyrtec

- Pepto-Bismol

- Cortizone

Please note that vitamins, supplements, and probiotics are not classified as over-the-counter drugs and will require a letter from a doctor stating the medical need for reimbursement.

Of course, there are many more examples of OTC drugs you can find at your pharmacy or online. Here’s a helpful resource of common OTC drugs and the conditions they help relieve.

What's the difference in an HRA vs FSA?

If you're comparing HRA vs FSA, here's what to remember.

HRAs, like QSEHRAs, and FSAs are tax-advantaged healthcare tools. HRAs are funded by employers, while FSAs allow employees to contribute pre-tax funds. HRAs offer more flexibility in expenses covered, including health insurance premiums, and unused funds can sometimes be rolled over. FSAs typically have a "use it or lose it" rule, forfeiting unspent funds at the end of the plan year.

QSEHRA Plan FAQs

Thanks for reading our guide on QSEHRA Reimbursement, we hope it was helpful! We want to remind you again that we are not licensed tax professionals, please don’t construe the information we’ve provided as official tax advice.

If you’re looking for more information, we recommend you check-out our Frequently Asked Questions (FAQ) database on QSEHRA. We’re always learning and adding to this database. We've pulled a few common frequently asked questions (FAQ) we receive about QSEHRA Reimbursements below:

Frequently Asked Questions

Do QSEHRA reimbursements count towards my gross income?

In general, QSEHRA reimbursements do not count against your income as long as your reimbursements qualify for pre-tax treatment. See our chart above in the "Health Plans & Premiums" section.

Are dental and vision insurance premiums reimbursable?

Yes, dental and vision insurance premiums are eligible for pre-tax reimbursements under a QSEHRA as described in IRS Section 213(d) and IRS Publication 502. However, employees must meet and maintain the MEC requirements to participate in the QSEHRA (stand-alone dental and vision insurance plans would not qualify as MEC on their own).

Note: Dental and Vision premiums can be reimbursed as “premium” expenses and therefore do not require an employer to have included “Medical Expense” reimbursement as part of the terms of the QSEHRA. However, dental and vision expenses would only be reimbursed if “Medical Expense” reimbursements are allowed.

If I reside in a foreign country, can I receive QSERHA reimbursements from my US-based employer?

Yes, provided you are a citizen or resident of the United States that has established your tax home in a foreign country. See IRS Section 5000A(F)(4) and Section 911(d)(1) for more information and consult your tax advisor. For more information about using a QSEHRA abroad, see this blog article.

What if my medical expenses are greater than my monthly QSEHRA reimbursement allowance?

Well first, we’re sorry if you have a large medical bill. That’s a bummer. To answer your question though, you should still submit it to your QSEHRA administrator. Although you can only receive the monthly maximum allowance set by the employer, your expense can “roll forward” and you can get reimbursed for it in future months. For more details and a great example of how large expenses work with QSEHRA, please see this help article.

If I don’t use my QSEHRA reimbursements, do I get to keep it? What if I leave my job?

No. QSEHRA funds remain with the employer until they are claimed by an employee. Typically, monthly balances will roll over each month and then reset at the end of the year (that’s up to your QSEHRA sponsor though).

Does my QSEHRA balance roll-over each year?

Maybe, maybe not. It’s up to your QSEHRA sponsor (ie, your boss) to decide whether or not to allow roll-over balances. Most of our clients do not allow roll-over amounts, but you still have 90 days to make claims on the previous plan year. Ask your QSEHRA sponsor or check your plan notices to see if roll-overs are allowed. Note: Roll-over amounts are capped at the annual QSEHRA limits.

Do I have to report QSEHRA reimbursements on my taxes?

Your QSEHRA Administrator should handle this for you. There are some amounts that have to be reported on your W-2 for informational purposes. Any reimbursements you receive that are taxable may impact some income reporting. Here’s a blog article that explains how tax reporting works for QSEHRA.

If I’m an owner of my company, can I get QSEHRA reimbursements too?

It depends on if you’re also an employee of the company. The rule-of-thumb here is do you also receive a W-2 for being an employee of your company? This is something you should talk to your accountant or attorney about to be sure. There are more resources and information in the “Requirements” section of our QSEHRA Guide.

Let's talk through your HRA questions

Hi, I'm Jack and I wrote this guide to help you make the most of your QSEHRA reimbursements. I had a lot of help from my team and our attorney too!

As a licensed health professional and leading QSEHRA expert, I've been published in the New York Times, Wall Street Journal, Forbes, and others on helping small employers realize the potential of QSEHRA. I am a small business owner and have an MBA from Wharton.

If you have any questions, please chat with me or my team or fill out the form below. Thanks for reading!