Retail Health Insurance

Unraveling the Health Benefit Maze: Harnessing the Power of HRAs in the Retail Industry

As a retail business owner, you've got your hands full. Juggling inventory, customer service, marketing, and daily operations is no small feat. Adding the complexity of navigating health benefits for your diverse workforce to this mix might seem overwhelming. But what if we told you there's a way to unravel the health benefit maze without losing sight of your other priorities?

Enter Health Reimbursement Arrangements (HRAs) – a powerful tool that can transform the way you offer health benefits to your employees. HRAs, particularly Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs) and Individual Coverage Health Reimbursement Arrangements (ICHRAs), are designed to offer flexible, cost-effective health benefit solutions, a feature that can be a game-changer for the dynamic world of the retail industry.

Whether you're operating a large retail chain or a small local shop, this article will guide you through the unique health benefit needs of the retail industry and help you understand why HRAs could be your best bet. We'll also explore how to choose the right HRA for your business and offer practical implementation tips, all with the aim of helping you harness the power of HRAs.

There's a reason we count retailers among one of the largest sectors of our clients.

Which HRA is right for you?

Understanding the Retail Industry's Unique Health Benefit Needs

The retail industry is an incredibly vibrant and dynamic sector, with a workforce as diverse as the products on the shelves. This diversity is shaped by a mix of full-time, part-time, and seasonal employees, each with their unique health benefit needs. This heterogeneity in employment types necessitates a health benefits plan that is just as flexible and adaptive.

And the retail industry is characterized by high employee turnover rates. The ebb and flow of employees moving in and out of the business can make it difficult for retailers to predict long-term costs associated with traditional health insurance plans. This fluctuation, coupled with varying work hours, can lead to challenges in meeting eligibility criteria for conventional group health insurance, as they typically require a certain number of work hours to qualify.

There’s also seasonal spikes in hiring to consider. For instance, during the holiday season, many retailers employ a substantial number of temporary staff to meet increased demand. These employees might be left out of traditional health insurance plans, leading to a disparity in benefits.

Small retailers in particular may struggle to offer competitive health insurance due to budget constraints and limited resources. Larger retailers, while they might be able to absorb the cost, can still face challenges in managing diverse employee needs and preferences with a one-size-fits-all insurance plan.

Beyond these structural factors, there's also the issue of age and lifestyle diversity. Retail employees range from high school students working part-time jobs, to single adults, to parents supporting families. The health needs of these different demographics can vary widely, further complicating the process of selecting suitable health benefits.

It's clear that traditional health insurance plans often fall short in providing the flexibility and inclusivity that the retail environment demands. This is where HRAs can make a significant difference. HRAs offer an adaptable solution that can adjust to a retailer's unique circumstances, regardless of size, employee diversity, or turnover rate, thereby providing a health benefits solution that truly fits.

The Edge of HRAs for Retailers: Flexibility, Tax Benefits, and Cost Control

In the bustling retail world, finding a health benefits solution that fits your unique needs can feel like trying to find a needle in a haystack. Good news, retailers, HRAs might just be the 'needle' you're looking for. Here's why:

Flexibility – A Perfect Fit for Every Retailer

One of the standout features of HRAs is flexibility. HRAs aren't a one-size-fits-all deal; they're designed to adapt to a wide array of business types and sizes, making them an ideal match for the ever-diverse retail industry.

Have a mix of full-time, part-time, and seasonal workers? No problem. With an HRA, particularly an Individual Coverage HRA (ICHRA), you can customize your health benefits offering to fit the needs of different employee classes. This means you can provide a competitive, meaningful benefits package to all your employees, no matter their employment status.

Tax Benefits – A Win-Win for Employers and Employees

When it comes to tax advantages, HRAs really shine. For you, the business owner, contributions made to an HRA are tax-deductible. This can help lower your overall business taxes, freeing up resources that can be used elsewhere.

Your employees benefit too. The money employees receive through an HRA is tax-free when used for eligible health care expenses. This effectively increases their take-home pay, making your business a more attractive place to work. It's a win-win!

Cost Control – You're in the Driver's Seat

HRAs give you the ability to control costs effectively. Traditional health insurance plans can surprise you with rate hikes year after year, but with an HRA, you decide how much to contribute.

Whether you choose a QSEHRA with its set contribution limits, or an ICHRA with more flexibility, you have a say in what you spend. This can help you budget more effectively and bring predictability to what can often be a volatile expense.

So there you have it, retailers! HRAs offer the flexibility to accommodate your diverse workforce, tax benefits for both you and your employees, and the ability to control health benefit costs effectively. Sounds like an excellent fit for the retail industry, don't you think?

Discover the power of HRAs & take command of your health benefits strategy!

A Glowing Success Story: Ultraceuticals and Their Journey with HRAs

You've heard us talk about the potential of HRAs for retail businesses, but there's nothing quite like a real-world example to bring the benefits to life. That's where our case study featuring Ultraceuticals, a global leader in the skincare industry, comes in. Let's take a closer look at how they leveraged an HRA to transform their health benefits strategy with the help of Take Command.

The Challenge:

Ultraceuticals, an Australian-based company, was expanding its footprint into the United States. As part of their growth strategy, they needed to attract and retain top talent to compete in the highly competitive skincare market. The challenge was providing quality health benefits to their U.S. employees without the hefty price tag and administrative headache often associated with traditional group health plans.

The Solution:

In their quest to find a practical solution, Ultraceuticals partnered with Take Command. Together, we decided that an ICHRA was the ideal solution for their situation. An ICHRA offered the flexibility to provide health benefits that could attract high-caliber employees, all while keeping costs manageable and predictable.

The Implementation:

With Take Command leading the way, Ultraceuticals rolled out their new ICHRA. Our team handled all the technical details, ensuring that the plan complied with all the relevant laws and regulations. We also provided the resources and support that Ultraceuticals needed to communicate this change to their team and help their employees understand their new benefits.

The Result:

The outcome? A resounding success. Ultraceuticals was able to offer their U.S. employees a competitive health benefits package without breaking the bank. Employees now enjoy the freedom to choose the healthcare plans that best suit their needs, and Ultraceuticals has managed to contain costs and simplify administration.

Moreover, employees appreciated the company's commitment to their well-being, which led to increased employee satisfaction.

Ultraceuticals' success story is a powerful testament to the potential of HRAs. It's a shining example of how a retail business, even one operating across international borders, can effectively leverage HRAs to create a health benefits strategy that's a win for both the company and its employees.

Ready to write your own success story? Partner with Take Command and let's chart your journey towards a better health benefits strategy.

We’re ready when you are!

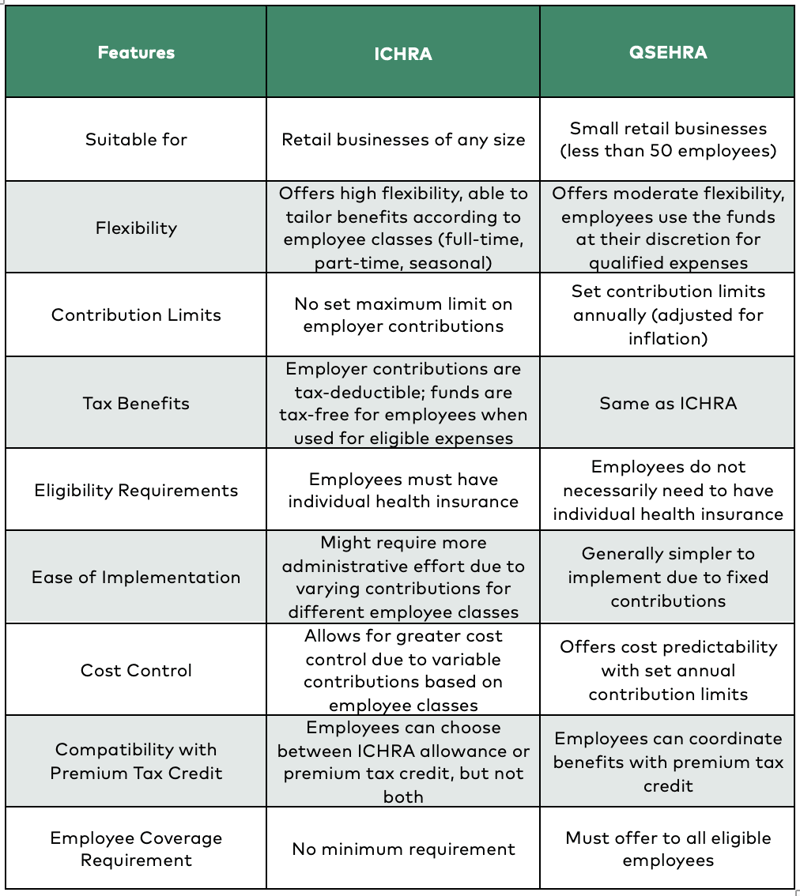

QSEHRA vs ICHRA: Navigating the Health Benefits Landscape for Retailers

Choosing the right HRA for your retail business can feel like a daunting task, especially when you're trying to compare QSEHRA and ICHRA. But don't fret, we're here to make this comparison simpler!

QSEHRA: The Simple Solution for Small Retail Businesses

Let's start with QSEHRA. It's the little sibling in the HRA family, designed with the needs of small businesses in mind. If you have fewer than 50 employees, QSEHRA can be your ticket to providing health benefits without the headache.

QSEHRA is all about simplicity and cost-effectiveness. It allows you, the employer, to set a fixed budget for health benefits every year. This means you won't get any nasty surprises in the form of unexpected rate hikes. Plus, your employees have the freedom to use their QSEHRA funds for health insurance premiums or qualified medical expenses.

Also, setting up a QSEHRA is generally straightforward, and administering it is quite manageable, making it a practical choice for smaller retailers who may not have a large HR department.

ICHRA: The Customizable Choice for Retail Businesses of All Sizes

Now, let's move on to the ICHRA, QSEHRA's more flexible sibling. While QSEHRA has its strengths, if you have a diverse workforce or if you're a larger retailer, ICHRA might be a better fit.

ICHRA brings a new level of customization to the table. It doesn't set a maximum limit on employer contributions, giving you the freedom to determine how much you want to offer your employees. Plus, you can adjust your contributions based on employee classes. Full-time, part-time, seasonal, different geographic locations – you can set different contribution rates for them all.

Another bonus of ICHRA? It allows you to offer health benefits to your employees while they choose the health insurance plan that best fits their needs. This can lead to increased employee satisfaction and higher retention rates.

QSEHRA or ICHRA: Which One Is for You?

In the end, whether you choose QSEHRA or ICHRA will depend on the unique needs of your retail business. If you're a small retailer looking for a simple, cost-effective solution, QSEHRA might be the way to go. But if you're a larger business or have a diverse workforce, the customization offered by ICHRA could be a game-changer.

No matter your choice, remember that both QSEHRA and ICHRA offer flexibility, tax advantages, and cost control that make them excellent health benefit options for retailers. Discover the power of HRAs and take command of your health benefits strategy.

Wondering how you could design your HRA?

Choosing Between QSEHRA and ICHRA: Your Guide to Making the Right Decision

Picking the right HRA for your retail business can seem like a tough task, but with a little guidance, you can confidently choose the best option for your specific situation. When it comes to QSEHRA vs ICHRA, the decision boils down to understanding your business's unique needs and circumstances:

Size Matters: Are You a Small Retailer or a Large Retailer?

For smaller retailers with less than 50 employees, the straightforward and cost-effective approach of QSEHRA might be the perfect fit. Its simplicity is its greatest strength – offering a set annual contribution limit that ensures cost predictability.

On the other hand, larger businesses or those with a diverse mix of employee classes might find the ICHRA more appealing. The absence of a cap on contributions and the flexibility to differentiate benefits based on employee classes provide a level of adaptability that large and diverse businesses often require.

Understanding Your Workforce: A One-Size-Fits-All Approach or Custom-Tailored Benefits?

ICHRA is a great choice if your workforce is highly diverse – with a mix of full-time, part-time, and seasonal workers, for example. This type of HRA allows you to customize benefits based on these employee classes, ensuring that your health benefits package is as diverse as your team.

If your team is more homogeneous and you're looking for a simpler, streamlined benefits solution, QSEHRA could be your go-to option.

Budget Considerations: How Much Can You Afford to Offer?

Your budget for health benefits also plays a crucial role in deciding between QSEHRA and ICHRA. If you have a fixed budget and prefer predictability in costs, the set annual contribution limits of QSEHRA could be more suitable.

However, if you're willing and able to invest more in health benefits and desire the flexibility to adjust contributions based on employee classes, ICHRA might be the right choice.

Empowering Your Decisions with Innovative Tools

In the complex world of health benefits, having the right tools at your disposal can make a world of difference. They can not only simplify the decision-making process but also provide a personalized perspective on the potential impact of these decisions on your business. At Take Command, we're proud to offer two such innovative tools designed to empower you in your journey with HRAs - our HRA Tax Savings Calculator and our ICHRA Affordability Calculator.

- HRA Tax Savings Calculator: Deciding on a health benefits strategy is not just about understanding what it will cost, but also about exploring the potential savings it can bring, particularly in the form of tax benefits. That's where our HRA Tax Savings Calculator comes in. This user-friendly tool is designed to give you an estimate of the tax savings you could enjoy by switching to an HRA.

Simply input your basic business and employee information, and let the calculator do the rest. In just a few clicks, you'll gain a clearer understanding of the tax advantages an HRA could bring to your retail business, empowering you to make an informed decision about your health benefits strategy.

- ICHRA Affordability Calculator: With the flexibility and customization that ICHRAs offer, they can be an appealing option for many retail businesses. But how much can you afford to contribute? And how does that compare to the cost of traditional group health plans? Our ICHRA Affordability Calculator can help answer these questions.

This intuitive tool helps you estimate the cost of providing your employees with an ICHRA based on various factors, such as your location, employee demographics, and intended contribution. It then compares this cost to the national average cost of group health plans, giving you a side-by-side comparison of the potential costs of these two health benefits options.

Delving Deeper into the Tax Benefits of HRAs: A Win-Win for Retail Businesses and Employees

Let's be honest, taxes can be a bit daunting. But when it comes to HRAs, taxes become a whole lot friendlier. In fact, one of the key advantages of HRAs, including QSEHRAs and ICHRAs, lies in their tax benefits. So, let's delve deeper and see how HRAs can bring a tax win-win situation for retail businesses and their employees.

HRAs For Retail Business Owners

As a retail business owner, every penny counts, especially in a competitive and dynamic industry. HRAs offer a way to manage health benefits costs while also reaping tax benefits:

Tax-Deductible Contributions

When you contribute to your employees' HRAs, these contributions are tax-deductible for your business. That means the amount you contribute reduces your taxable income, leading to potential tax savings.

Let's illustrate this with an example. Suppose you own a small clothing boutique with 10 full-time employees. If you contribute $300 per month per employee to a QSEHRA, that's a total of $36,000 ($300 x 10 employees x 12 months) in tax-deductible expenses for the year. This deduction could significantly reduce your business tax bill.

HRAs For Retail Employees

Your employees also stand to benefit from the tax advantages of HRAs, making this a valuable perk to attract and retain your workforce:

Tax-Free Reimbursements

When your employees use their HRA to pay for eligible healthcare expenses, these reimbursements are tax-free. They won't have to include these amounts in their taxable income when tax time rolls around.

To illustrate, let's imagine one of your employees, let's call her Jane, from your boutique. Jane incurs $2,500 in eligible healthcare expenses throughout the year. If Jane is in the 22% tax bracket, by using her tax-free HRA funds to pay for these expenses, she effectively saves $550 ($2,500 x 22%) that she would have otherwise paid in taxes if she had used her after-tax dollars for these expenses.

Understanding the tax benefits of HRAs can help you see the true value these arrangements can bring to your retail business and your employees. They make HRAs not just a cost-effective health benefits solution, but also a smart tax strategy. As always, it's a good idea to consult with a tax professional to understand the full implications for your specific business situation. And remember, our HRA Tax Savings Calculator is also there to give you an estimate of your potential tax savings.

So, why not take command of your health benefits strategy and enjoy the tax advantages that HRAs can bring? Your bottom line and your employees will thank you.

Unlock tax advantages with an HRA. Find out more today.

Need a Helping Hand? Take Command is Here for You!

As the leader in HRA administration, Take Command is your go-to partner in navigating these decisions. We know that every retail business is unique, and our goal is to help you choose and implement the HRA that's just right for you.

With our expertise in both QSEHRA and ICHRA, we'll guide you through the process of selecting the best health benefits solution that meets your business size, caters to your workforce diversity, and respects your budget.

So, why go it alone? Take Command of your health benefits strategy and let us help you create a plan that truly fits your retail business's needs.

Smooth Sailing to HRA Implementation: Practical Tips and the Role of HRA Administration Companies

Switching to an HRA for your retail business's health benefits might seem like a mammoth task at first. But trust me, it doesn't have to be an uphill battle. With some planning, clear communication, and a little help from HRA administration experts, you'll be sailing smoothly in no time.

Setting Your Course: Determine Your Budget and Employee Classes

Your first step in the journey towards HRA implementation is to set your course. Determine your budget for health benefits - how much can you afford to contribute each month? Remember, with HRAs, you're in control of this, so find a number that suits your financial plan.

Next up, think about your crew – your employees. Are they full-time, part-time, or seasonal? Do you operate in different locations with different living costs? By defining these employee classes, you'll be better equipped to structure your HRA, especially if you're going with an ICHRA.

All Hands on Deck: Communicate Clearly with Your Employees

Your employees are at the heart of your retail business. So, when you're making changes to their health benefits, it's essential to keep them in the loop.

Make sure your communication is clear, concise, and jargon-free. Explain what an HRA is, how it works, and what it means for them. Will they have more choice in their healthcare? More control over their costs? These are the things your employees will want to know.

Also, consider providing resources for your team to understand their new benefits. This could be in the form of informational handouts, explainer videos, or even Q&A sessions. We have tons of employee resources to make it easy for you.

HRA Administration Companies: Your Implementation Sherpa

If the prospect of implementing an HRA still feels daunting, don't worry. You don't have to navigate these waters alone. This is where HRA administration companies, like Take Command, come into play.

As a leading HRA administration company, Take Command is your partner in easing your transition to HRAs. Our mission is to help you plot the best course forward, ensuring your HRA plan is fully compliant with all the relevant laws and regulations.

And we don't stop there. We also handle all the administrative work associated with your HRA. This includes managing reimbursements, providing necessary tax documentation, and being there to answer any questions you or your employees might have.

But what sets us apart is our commitment to guiding you and your employees through every step of the process. We believe in empowering you to take command of your health benefits, and we're here to support you along the way.

So, ready to embark on your HRA journey? With these implementation tips and Take Command at your side, you're all set for smooth sailing ahead.

Join the future of health benefits. Get started today.

Your Call to Action for Better Employee Health Benefits

HRAs, and specifically QSEHRAs and ICHRAs, are more than just health benefits options – they're a dynamic way to empower your employees and strengthen your retail business. By providing flexibility, control over costs, and tax benefits, HRAs offer a solution that is adaptable to the unique circumstances of the retail industry.

So, retailers, this is your call to action. It's time to take command of your health benefits strategy and harness the power of HRAs. No more settling for traditional health insurance plans that fall short of meeting your diverse needs. Instead, embrace a solution that offers adaptability and cost-effectiveness.

And remember, you don't have to do this alone. Partner with us at Take Command. As experts in HRA administration, we'll be with you every step of the way. From choosing between QSEHRA and ICHRA, to setting up and implementing your HRA plan, we'll provide the guidance and support you need.

Let's work together to create a health benefits strategy that's tailor-made for your retail business, one that caters to your unique needs and boosts employee satisfaction.

Reach out to us today, and let's embark on this journey to better health benefits, together!

Frequently Asked Questions: Your Quick Guide to HRAs

We've covered a lot about HRAs, QSEHRAs, and ICHRAs. But we understand that you may still have questions. So, let's wrap things up with a few common inquiries that retail business owners often have about HRAs:

What if I have both full-time and part-time employees? Can I still use an HRA?

Absolutely. In fact, this is one of the areas where HRAs, and ICHRAs in particular, shine. They allow you to differentiate benefits based on employee classes. So, you can provide different benefits to full-time, part-time, seasonal employees, or any other classes you define.

Are there any tax benefits with HRAs?

Yes, there are! One of the biggest advantages of HRAs is the tax benefits they provide. Employer contributions are tax-deductible, and employees enjoy tax-free use of these funds for eligible healthcare expenses.

How much can I contribute to an HRA?

For QSEHRAs, there are set contribution limits adjusted annually for inflation. For ICHRAs, there are no set maximum limits, giving you more flexibility in deciding how much to contribute based on your budget and your employees' needs.

Can I use an HRA if I already offer traditional group health insurance?

The answer depends on the type of HRA. With an ICHRA, you can offer it alongside a traditional group health insurance plan, but you cannot offer both to the same employee class. QSEHRAs, however, can only be offered if you do not offer a group health insurance plan.

What kind of expenses can be covered with an HRA?

HRAs can be used to reimburse a variety of medical expenses that are considered eligible by the IRS. This can include premiums for individual health insurance, out-of-pocket medical, dental, and vision costs, and many other healthcare expenses.

Remember, every retail business is unique, and these answers might not cover all your questions. That's where we at Take Command come in. Reach out to us, and we'll help guide you through the ins and outs of HRAs, ensuring you're well-equipped to provide the best health benefits for your retail business.

Let's talk through your HRA questions

Fill out the form below to connect with our team and see if an HRA is a good fit.

Susanne is a copywriter specializing in the health and wellness industry. Before starting her own business, she spent nearly a decade at a marketing agency doing all of the things – advisor, copywriter, SEO strategist, social media specialist, and project manager. That experience gives her a unique understanding of how the consumer-focused content she writes flows into each marketing piece. Susanne lives in Oklahoma City with her husband and two daughters. She loves being outdoors, exercising and reading.