Overview

Overview

Navigating the complexities of small business health insurance in Georgia can be challenging. Still, ensuring your employees' well-being and your business's success is crucial. This comprehensive guide is designed to help Georgia's small business owners understand their health insurance options, the legal requirements specific to the state, and the strategies to manage costs while providing valuable benefits.

Whether you're exploring health insurance for the first time or looking to optimize your current benefits package, this guide aims to provide you with the information you need to make informed decisions.

From understanding state-specific regulations, exploring the marketplace, leveraging tax advantages, and choosing between traditional insurance plans and alternative solutions like HRAs, we've got you covered.

Let's dive into the essentials of Georgia's small business health insurance, helping you navigate the options, obligations, and opportunities available to your business and your team.

Table of Contents

- Overview

- Understanding the Marketplace

- Georgia's Exciting Leap: A Brand New Health Insurance Marketplace!

- Health Insurance Options for Georgia Small Businesses

- Group Health Insurance for Georgia Small Businesses

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Exclusive Provider Organizations (EPOs)

- Point of Service Plans (POS)

- Self-funded Health Plans

- Health Sharing Plans

- HSAs

- Direct Primary Care

- Group Health Insurance for Georgia Small Businesses

- Why Georgia's New Marketplace and HRAs Are a Winning Combo for Businesses

- Georgia's Blooming Health Insurance Garden

- HRAs: The New Buzz in Town for Businesses

- Wrapping It Up with a Bow

- ICHRA vs. QSEHRA: The Dynamic Duo of Health Reimbursement Arrangements

- Individual Coverage Health Reimbursement Arrangement

- Qualified Small Employer Health Reimbursement Arrangement

- Group Health Insurance vs HRAs: Why Georgia Businesses are Eyeing a Change

- Group Health Insurance Unzipped: The Old Guard

- HRAs: The Fresh Beat in Health Benefits

- Individuals Rejoice: Custom Plans and Freedom!

- ICHRA vs QSEHRA Comparison

- Navigating HRA Administration with Take Command at the Helm!

- Meet Take Command: Your HRA BFF!

- Making HRA Life Breezy with Take Command

- Premier Software is Like a Rock Concert for HRAs

- Getting Your HRA Up and Running: A Friendly Guide!

- Making the Right Health Benefit Choices for Your Business

- Your Top Questions Answered: Why HRAs Shine in GA for Small Business Health Options

- What's the best health insurance deal for small businesses in Georgia?

- Alright, so why are HRAs the crown jewel for GA's small business health perks?

- But there's got to be a catch, right? Any downsides to HRAs in GA?

- What's the price tag on group health insurance for GA's small businesses?

- Need a trusty health insurance broker in Georgia? How do you find one?

- Picking a health plan for your GA small business? What should be on your checklist?

- Let's talk through your HRA questions.

Understanding the Marketplace

In Georgia, small business owners exploring health benefits for their employees find a broad spectrum of options, from traditional group plans to innovative solutions like Health Reimbursement Arrangements (HRAs). Adopting a comprehensive approach to navigating this complex landscape becomes crucial amid evolving healthcare requirements and the rising costs of traditional health insurance.

HRAs stand out for their flexibility and tax advantages. They allow businesses to reimburse employees for medical expenses and health insurance premiums tax-free. This arrangement offers customization to match a business's unique needs, providing a cost-controlled benefit that employers and employees value. However, Georgia's health insurance marketplace offers much more beyond HRAs, including group health insurance plans, Health Savings Accounts (HSAs), and access to the Small Business Health Options Program (SHOP).

Group health insurance plans offer extensive coverage through pooled risk, which can stabilize premiums. HSAs, when paired with high-deductible health plans, afford another layer of tax savings and empower individuals to manage their healthcare spending more effectively. SHOP, tailored specifically for small businesses, showcases a variety of plans to accommodate diverse needs and budgets.

Georgia Access, the state-run health insurance marketplace, further broadens the options available to small businesses in Georgia. Operated by the state and designed to increase competition and consumer choice, Georgia Access connects companies and individuals directly with insurers, facilitating the exploration and comparison of health plans. This platform reflects the state's initiative to better tailor the health insurance landscape to meet the needs of its residents and businesses, offering an additional resource for finding cost-effective health coverage.

With the recent legislative shifts giving Georgia more control over its health insurance market, now is an opportune time for businesses to reevaluate their health benefits strategy. Companies can craft a comprehensive benefits package by thoroughly exploring all options—HRAs, group insurance, HSAs, SHOP, and state-run plans like Georgia Access. This strategy positions companies as competitive employers and ensures they navigate the health benefits landscape confidently, catering effectively to their financial constraints and their employees' healthcare needs.

Georgia's Exciting Leap: A Brand New Health Insurance Marketplace!

Big news on the health front: Governor Brian Kemp has given the green light for the Peach State to craft its own health insurance marketplace. This move promises to simplify the process of comparing and selecting health insurance options.

Here's the scoop:

Thanks to Senate Bill 65, Georgia is ditching the old law and paving the way for a state-run health care exchange. This is a massive shift from the earlier stance against the Affordable Care Act.

Remember the federal Healthcare.gov? While it served nearly 900,000 Georgians before, the hope is to launch Georgia's unique platform as early as this November. Fingers crossed!

Kemp's original idea was a tad different. He imagined a space where private brokers offered a mix of policies. However, after some discussions and valuable feedback, the decision is to focus on a central state marketplace with only federally approved plans. All for the best!

Having spent $31 million on preparations, the Kemp administration is all set and eager to roll this out.

Laura Colbert of Georgians for a Healthy Future points out some cool perks we might enjoy, like extended enrollment periods and an all-in-one application for state health programs. Exciting times are ahead, and we're thrilled to keep you updated!

Health Insurance Options for Georgia Small Businesses

For small business owners in Georgia, navigating the health insurance landscape can be a complex but crucial part of ensuring employee well-being and satisfaction. Various health insurance options are available, each catering to different needs, preferences, and financial considerations. Understanding the nuances of these options—including group health insurance plans, self-funded plans, health sharing plans, Health Savings Accounts (HSAs), and Direct Primary Care—can help small businesses in Georgia make informed decisions.

Group Health Insurance for Georgia Small Businesses

Group health insurance is a popular choice for many small businesses in Georgia, offering comprehensive coverage to employees under a single policy. These plans are facilitated by the employer, who typically shares the cost of premiums with employees.

Health Maintenance Organizations (HMOs)

HMOs are characterized by their network of providers and the requirement to choose a primary care physician (PCP). These plans offer small businesses in Georgia a cost-effective solution with lower premiums and out-of-pocket costs. However, coverage is limited to services provided by in-network physicians, except in emergencies.

Preferred Provider Organizations (PPOs)

PPO plans offer more flexibility than HMOs, allowing employees to see specialists without a referral and receive care from out-of-network providers, though at a higher cost. For small businesses in Georgia, PPOs provide a balanced option between cost and flexibility.

Exclusive Provider Organizations (EPOs)

EPOs are similar to PPOs but typically do not cover out-of-network care except for emergencies. These plans can be a cost-effective option for Georgia small businesses looking for the flexibility of a PPO but are willing to limit coverage to in-network providers.

Point of Service Plans (POS)

POS plans combine elements of HMOs and PPOs. They require a primary care physician for referrals to specialists but also offer coverage for out-of-network providers at a higher cost. This option offers a versatile health insurance solution for small group health insurance in Georgia, balancing cost with provider choice.

Self-funded Health Plans

Self-funded health plans, where the employer assumes the financial risk for providing health care benefits, can be a viable option for some small businesses in Georgia. These plans offer flexibility in design and potential cost savings but require careful management of financial risks associated with employees' healthcare claims.

Health Sharing Plans

Health-sharing plans are cooperative arrangements among individuals who share medical expenses. While not traditional insurance, these plans can offer an alternative for self-employed health insurance in Georgia, providing a community-based approach to managing health care costs.

HSAs

Health Savings Accounts (HSAs) paired with high-deductible health plans (HDHPs) offer small businesses and their employees a tax-advantaged way to save for medical expenses. HSAs are particularly beneficial for small businesses in Georgia looking to provide health benefits while encouraging employees to manage their healthcare spending.

Direct Primary Care

Direct Primary Care (DPC) is an innovative model where businesses or individuals pay a flat monthly fee for access to primary care services without the complexity of traditional insurance billing. For small businesses in Georgia, DPC can complement other health insurance options, offering employees personalized and accessible primary care services.

Navigating small business health insurance in Georgia involves carefully assessing the business's and employees' needs, preferences, and financial capabilities. Small businesses can craft a comprehensive and effective health benefits strategy by understanding the options available, from Georgia group health insurance to innovative models like HSAs and Direct Primary Care.

Why HRAs May be the Best Fit For Your Georgia Small Business

Health Reimbursement Arrangements (HRAs) are increasingly recognized as a versatile and cost-effective health benefits solution for small businesses in Georgia. Offering a blend of flexibility, control over costs, and tax advantages, HRAs can be an ideal fit for small business owners looking to provide valuable health benefits to their employees. Here are several reasons why HRAs may be the best choice for your Georgia small business:

Financial Control and Predictability

HRAs allow small businesses in Georgia to set their budgets for health benefits by deciding how much they want to reimburse their employees for healthcare expenses. This control over costs helps businesses manage their budgets more effectively, providing a predictable expense line item each year.

Tax Benefits

With HRAs, both employers and employees stand to gain significant tax advantages. Businesses' contributions to an HRA are tax-deductible, lowering their taxable income. Employee reimbursements for qualified health care expenses are tax-free, providing them with more value for their health benefits.

Customization to Meet Diverse Needs

One size rarely fits all, especially when it comes to health insurance. HRAs offer a customized approach tailored to your workforce's diverse healthcare needs. Employees can choose their health insurance plans and medical services that best suit their needs and preferences, enhancing satisfaction and engagement.

Easy to Administer

Compared to traditional health insurance plans, HRAs are relatively easy to administer. With the support of platforms like Take Command, small businesses in Georgia can efficiently manage their HRA plans, from setting up the arrangement to processing reimbursements and ensuring compliance with regulatory requirements.

Encourages Employee Autonomy

HRAs empower employees by giving them the autonomy to make healthcare decisions. This autonomy can lead to more responsible healthcare consumption, as employees can shop for cost-effective insurance plans and medical services that align with their health needs and financial situations.

Complements Individual Health Insurance

In Georgia, where individual health insurance options are accessible through the marketplace, HRAs can complement these plans by reimbursing employees for their premiums and out-of-pocket medical expenses. This synergy between HRAs and individual health insurance plans can lead to a comprehensive health benefits package that is both affordable for the employer and valuable to the employee.

Aligns with Georgia's Health Insurance Landscape

With the introduction of Georgia Access and the state’s commitment to improving the health insurance marketplace, HRAs provide a flexible and compliant way for small businesses to navigate the evolving landscape. By leveraging HRAs, Georgia small businesses can offer competitive health benefits that attract and retain talent while adapting to legislative changes and market dynamics.

HRAs offer a compelling health benefits solution for Georgia small businesses, combining financial control, tax advantages, flexibility, and employee autonomy. This modern approach to health insurance meets the needs of today's workforce and positions small businesses in Georgia for success in a competitive market.

Which HRA is right for you?

Why Georgia's New Marketplace and HRAs Are a Winning Combo for Businesses

With Georgia forging its own health insurance marketplace, let’s dive into how this landscape can offer businesses like yours a splendid opportunity. Let’s chat about HRAs and why they’re making waves!

Georgia's Blooming Health Insurance Garden

Georgia's health insurance scene is like a garden with diverse blooms. We have private insurers bringing colors like HMOs, PPOs, and HDHPs to the table. Meanwhile, government initiatives like Medicaid and Medicare have their own vital role, catering to the low-income group and our lovely seniors. And let’s not forget the blossoms provided by businesses: employer-sponsored health plans. Each petal and leaf adds its unique charm and function to the garden.

HRAs: The New Buzz in Town for Businesses

Now, where do HRAs fit in this picture? Think of HRAs as those versatile garden tools that help make every plant thrive. By introducing HRAs, businesses can sprinkle a little extra sunshine on their employees. How? HRAs let you reimburse your team for certain medical expenses. It’s all tax-free, and it beautifully complements various health plans, especially those HDHPs.

What does this mean for your team? More choice, more flexibility! They can use HRA funds for those sometimes pesky out-of-pocket expenses, from deductibles to prescription shades. It's like giving them a little healthcare piggy bank they can tap into, ensuring they can smell the roses without stressing about healthcare costs.

Wrapping It Up with a Bow

To sum it all up, Georgia’s evolving health insurance landscape is opening doors for businesses to embrace HRAs. It's like adding a cherry on top of the sundae! With the right moves and a sprinkle of guidance, businesses can dance through this vibrant health insurance garden, picking the best blooms that cater to their needs and aspirations.

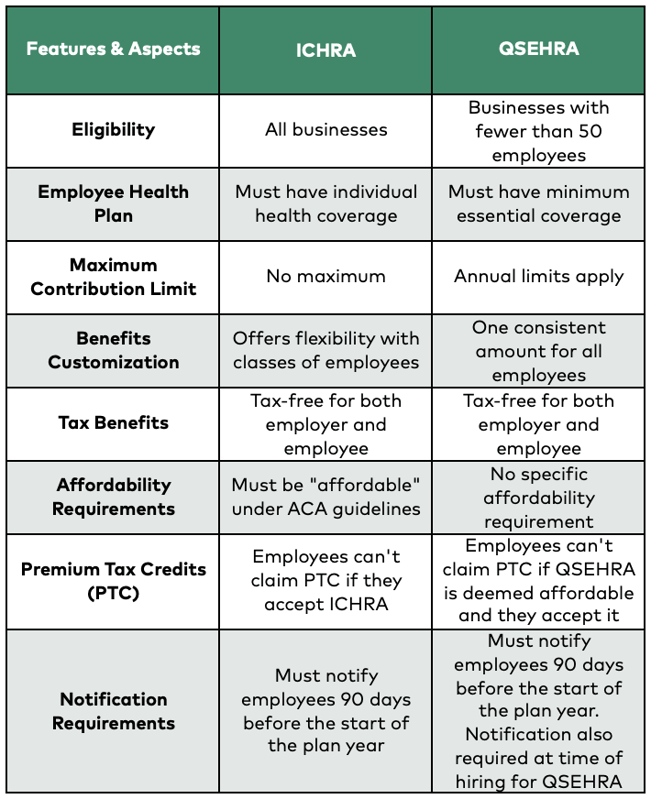

ICHRA vs. QSEHRA: The Dynamic Duo of Health Reimbursement Arrangements

Health Reimbursement Arrangements (HRAs) have transformed the way employers can provide health benefits to their employees. Within the realm of HRAs, two standout models have emerged: Individual Coverage Health Reimbursement Arrangement (ICHRA) and Qualified Small Employer Health Reimbursement Arrangement (QSEHRA). While they both offer businesses unique advantages, they cater to different needs and structures. Let's dive into their key features and differences.

Individual Coverage Health Reimbursement Arrangement

ICHRA offers a modern twist to employee health benefits, providing businesses with a flexible and customizable way to reimburse employees for their individual health insurance costs. Here’s the scoop.

- Flexibility with Employees: One of ICHRA's shining features is the ability to offer different reimbursement amounts based on classes of employees. This means you can provide different reimbursement rates to full-time vs. part-time workers, or based on geographic location, among other criteria.

- No Maximum Contribution Limits: Unlike QSEHRA, ICHRA does not have set annual contribution limits. This provides employers with the liberty to decide how much they want to reimburse employees.

- Employee Eligibility: Employees are required to have individual health insurance, either through the marketplace or another source, to participate in an ICHRA.

- Integration with Premium Tax Credits: Employees can't double-dip by receiving both ICHRA benefits and premium tax credits. If the ICHRA allowance is deemed "affordable," then the employee cannot claim the tax credits.

Qualified Small Employer Health Reimbursement Arrangement

QSEHRA presents a tailored health benefit solution for smaller businesses, enabling them to compensate employees for qualified medical expenses without the complexities of a traditional group plan. Here’s the scoop.

- Designed for Small Employers: QSEHRA is tailor-made for small businesses. Only companies with fewer than 50 employees who don’t offer a group health insurance plan can use QSEHRA.

- Annual Contribution Caps: $5,850 for individual employees $11,800 for employees with a family.

- Equal Reimbursements: Unlike ICHRA, QSEHRA requires employers to offer the same reimbursement to all eligible employees. However, adjustments can be made based on age and family size.

- Simpler Eligibility: Employees simply need proof of minimum essential coverage to be eligible for reimbursements. This can be through a spouse's plan, the marketplace, or other sources.

Choosing between ICHRA and QSEHRA depends on your business size, your budget, and your objectives for employee health benefits. Both HRAs offer tax advantages and can be more cost-effective and flexible than traditional group plans. Whether you're leaning towards the customization options of ICHRA or the small-business-friendly structure of QSEHRA, both options signal a forward-thinking approach to employee health benefits.

Group Health Insurance vs HRAs: Why Georgia Businesses are Eyeing a Change

Peach State entrepreneurs and workers, ever felt that group health insurance was a one-size-fits-all sweater that just didn’t snug right? Let's dive into why so many are shifting gears to HRAs and championing individual choice!

Group Health Insurance Unzipped: The Old Guard

Group health insurance is kinda like cafeteria food: it’s there, it’s convenient, but it might not be your personal favorite. The employer picks a plan, pays part of the premium, and then everyone gets the same dish. Everyone pays a portion, but is it always what you'd choose?

The Hitches with Group Plans

- Less Choice: Think of it as ordering for the table. Everyone gets the same thing, whether they're vegetarian, gluten-free, or meat-lovers. One plan for all might not address individual health needs.

- Costly for Employers: Scaling up? As the team grows, so can the price tag of group insurance. This could leave employers feeling the squeeze.

- Fixed Benefits: Unlike a custom playlist, you can't skip or add tracks. Employees get the same tune, regardless of their unique health rhythm.

HRAs: The Fresh Beat in Health Benefits

Here’s where HRAs shine like a Georgia sunrise. Imagine giving your employees some cash and saying, “Go get the health insurance that dances to your beat!” That’s an HRA.

Why HRAs Are The Talk of The Town

- Tailored Fit: Employees aren’t all wearing the same size. They pick a health plan that fits just right, from broad coverage to specialized care.

- Empowerment: Put the decision in their hands! Employees cherish the autonomy to choose and not just get served.

- Budget-Friendly for Employers: Set your limit and stick to it. HRAs offer predictable costs while delivering invaluable benefits.

Individuals Rejoice: Custom Plans and Freedom!

No more "thanks, I guess?" moments. With HRAs, employees get to cherry-pick plans that cater to their unique health needs. Got a family to consider? Need a specific doctor? Prefer a lower deductible? It's all in their hands. They select, get covered, and then, thanks to HRAs, get a sweet reimbursement for those costs.

So, Georgia businesses and workforce, there’s a health benefits revolution afoot. Moving from the traditional to the transformative, HRAs offer a blend of choice, control, and cost-efficiency.

ICHRA vs QSEHRA Comparison

Navigating HRA Administration with Take Command at the Helm!

HRAs are the new kids on the health benefit block! They're like a swiss army knife: flexible and ready for all your health benefit needs. But, managing the ins and outs of HRA, from compliance to those tax-free reimbursements, can sometimes feel like assembling a puzzle.

That’s where the superstars at third-party administrators, like Take Command, step into the spotlight and make the magic happen.

Meet Take Command: Your HRA BFF!

Enter Take Command: your go-to guru for everything HRA. Whether you're setting up your HRA or diving deep into tracking reimbursements, the folks at Take Command have your back. And we’re not just about the nuts and bolts! We also have a treasure trove of resources to make HRAs as easy as pie for employers and employees alike.

Making HRA Life Breezy with Take Command

With Take Command, the HRA world gets a whole lot sunnier. Set up your HRA in a jiffy, have employees float their reimbursement needs seamlessly, and, for those head-scratching moments, lean on their tools and resources. Whether it's compliance support or just wanting your plan to have a little extra flair, they've got you.

Premier Software is Like a Rock Concert for HRAs

Think of Take Command’s software as the ultimate VIP backstage pass to the HRA show. Here’s what’s on the setlist:

- Quick-as-a-flash online plan setup & management

- Keep tabs on all those employee reimbursements

- Ace the compliance game with their support & reporting

- Jazz up your plan so it’s just the way you like it

- Learn the HRA ropes with their handy resources

All in all? With Take Command’s software in your corner, you're not just managing HRAs; you're rocking them out, saving some cash, and ensuring your team gets those health benefit encores they deserve!

Getting Your HRA Up and Running: A Friendly Guide!

Georgia business owners, ever thought about giving your team the magic of an HRA? It's like a little health benefit wallet that tops up your employees for things like prescriptions, check-ups, and more. Plus, it's a win-win: your team gets awesome perks and you might just cut down on those hefty health insurance bills.

Here’s how to roll out the red carpet for your HRA

- Pick Your HRA Flavor: Like choosing your favorite ice cream, there are a few HRAs to choose from, including the snazzy QSEHRA and ICHRA. Think about what fits best with your team's vibe and your budget.

- Tailor it to Taste: Decide on the nitty-gritty: who gets what, and how much? Maybe you'll give everyone the same amount, or you might shake it up based on family size. Just remember there's a cap for each HRA type.

- Circle the Date: Mark the day you want to kick things off. No group health plans right now? Dive right in! Tip: Picking the start of a month can make things smoother.

- Review and Tweak Your Policy: Take a peek at your current insurance setup. You might need some tweaks to ensure you're on the right side of HRA rules.

- Craft and Share Your HRA Story: Whip up a clear doc that lays out the HRA details. Then, share the news with your team, making sure they're all clued in on their cool new perks.

- Spread the HRA Cheer: Get your team pumped about the HRA! Let them know the ropes, guide them on how to get those reimbursements, and be there for any Q&As.

Launching an HRA can be your ticket to a happier team and some neat savings. Stick to the game plan, follow the rules, and watch your HRA journey take flight!

Learn More about HRA Administration

Making the Right Health Benefit Choices for Your Business

Navigating the landscape of health insurance options for small businesses can be a daunting task. From understanding the fundamental differences between ICHRA and QSEHRA to exploring the potential advantages of HRAs, the journey to selecting the best fit requires careful consideration. As Georgia's small business landscape continues to evolve, so too do the health insurance needs of its entrepreneurs and their teams. Whether prioritizing flexibility, cost-effectiveness, or employee well-being, the ultimate choice should resonate with the company's values and growth goals. Remember, a well-informed decision today can pave the way for a healthier, happier, and more productive tomorrow for everyone involved.

We're here for you!

Talk to our team of experts today.

Your Top Questions Answered: Why HRAs Shine in GA for Small Business Health Options

What's the best health insurance deal for small businesses in Georgia?

While Georgia's small business owners have some choices, from high-deductible plans with HSAs to group insurance, the real MVP is the Health Reimbursement Arrangement (HRA). Why? HRAs are tailored for flexibility, cost-effectiveness, and giving employees personalized health solutions.

Alright, so why are HRAs the crown jewel for GA's small business health perks?

HRAs are like the secret sauce for small businesses in Georgia. They let you pitch in tax-free bucks to cover your team's health costs like deductibles and copays. This means fewer money worries for your crew and a big, shiny magnet to pull in the best talent out there.

But there's got to be a catch, right? Any downsides to HRAs in GA?

Every option has its nuances. With HRAs, your team needs a high-deductible health plan. Some folks might miss the familiarity of traditional group plans. But, with the perks and flexibility of HRAs, many businesses find they're more than worth it!

What's the price tag on group health insurance for GA's small businesses?

It's a bit of a mix. Depending on your business's specifics and the health and age of your team, you could be looking at anywhere from $200 to $500 monthly for each employee.

Need a trusty health insurance broker in Georgia? How do you find one?

Network, network, network! Chat with fellow GA business owners and get their recommendations. Make sure your broker's clued in on Georgia's unique small business vibe.

Picking a health plan for your GA small business? What should be on your checklist?

Dive into the details: premium costs, deductibles, copays, and which doctors are in-network. And, always, always consider what your team wants – after all, a happy crew is a productive crew!

In a nutshell? If you're after a health benefit option that's flexible, employee-centric, and cost-friendly, HRAs are your go-to in Georgia!

Let's talk through your HRA questions

Fill out the form below to connect with our team and see if an HRA is a good fit.

Susanne is a copywriter specializing in the health and wellness industry. Before starting her own business, she spent nearly a decade at a marketing agency doing all of the things – advisor, copywriter, SEO strategist, social media specialist, and project manager. That experience gives her a unique understanding of how the consumer-focused content she writes flows into each marketing piece. Susanne lives in Oklahoma City with her husband and two daughters. She loves being outdoors, exercising and reading.