Automobile Acceptance Corporation (AAC) is a business operating within the dynamic automotive sector, specializing in providing solutions tailored to their clientele's unique needs. For businesses like AAC, particularly small to medium-sized enterprises, finding affordable and comprehensive health benefits is a daunting task. The complexities of the health insurance market, coupled with rising costs, often make it challenging for such companies to strike a balance between cost-effectiveness and ensuring employee welfare. This struggle is intensified as they aim to attract and retain top talent in a competitive marketplace.

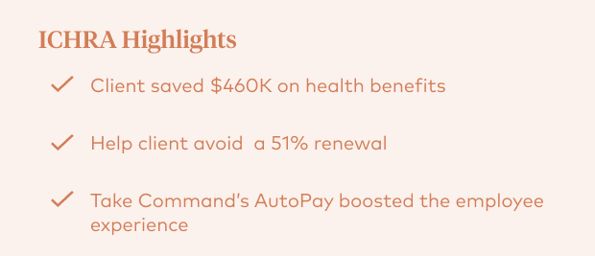

AAC faced a critical challenge: escalating group health coverage costs that surged by an unsustainable 51%. This financial strain jeopardized their ability to provide essential benefits to their employees. In response, AAC partnered with Take Command, identifying and implementing strategic solutions. The result? A remarkable $460K in savings.

In this success story, we'll detail how AAC addressed their challenges head-on and how other companies can potentially achieve similar outcomes with the right approach and partnerships.

The Backdrop: AAC's Pre-Take Command Landscape

An average day at AAC is a whirlwind of client meetings, strategy discussions, and navigating the many challenges that come with running a business in this dynamic industry. Add in trying to secure health benefits for your team, and that can be too much for anyones plate.

Before partnering with Take Command, AAC faced a series of challenges, both operationally and financially, particularly concerning employee health benefits. Like many other small to medium-sized businesses, securing affordable and comprehensive health benefits for its employees was a continuous uphill battle. Group health insurance costs continue to rise which makes it difficult — if not unattainable — to ensure quality health coverage without compromising financial stability.

To put this in perspective, AAC was spending over $400K on medical benefits alone, excluding other ancillary benefits. Such hefty expenditures were becoming unsustainable.

The tipping point came when AAC confronted a staggering 51% increase in costs. This financial spike was something the company couldn't absorb, demanding an urgent reconsideration of their health benefits strategy. Further complicating matters was AAC's diverse workforce spread across multiple states. This geographical spread meant navigating the complexities of different state regulations and securing multiple contracts, adding another layer to the challenge.

In this backdrop of escalating costs and operational complexities, it was clear that AAC needed a transformative solution — and fast.

Finding a Health Benefits Solution with Take Command

AAC's path towards a sustainable health benefits solution was paved through their long-standing relationship with OneDigital. Within this framework, a representative from OneDigital emerged as a pivotal guide, assisting AAC with her extensive industry expertise. This collaboration marked a notable milestone, with AAC becoming a prime employment group for OneDigital to introduce to the world of Individual Coverage Health Reimbursement Arrangement (ICHRA).

Embracing Change, Acknowledging Challenges

Transitioning to a new system, especially one as significant as employee health benefits, can present challenges. AAC's initial engagement with Take Command bore witness to a few hurdles, demanding quick responses and strategic shifts. A representative from Take Command stepped in, ensuring the journey transitioned from a rough start to a smoother engagement, laying the foundation for a rewarding partnership between AAC and Take Command.

Navigating tasks like contracting across various states and managing diverse administrative requirements, AAC sought more than just a service provider; they needed a genuine partner. Introducing the ICHRA during their fiscal year, rather than the standard calendar year, further complicated matters. However, with Take Command's guidance, every obstacle, from administrative nuances to accommodating employee health plan preferences, was met with tailored and innovative solutions, underscoring their role as a steadfast partner in HRA administration.

Refining Employee Health Benefits with Take Command

AAC faced significant challenges in communicating changes to employees, especially concerning upfront insurance payments. The introduction of the AutoPay feature, mirroring group plans, was a game-changer. Not only did it alleviate primary concerns by eliminating the need for employees to pay upfront, but it also streamlined the compliance process. This transition to Take Command was more than just a switch in service providers; it symbolized a profound transformation in AAC's approach to employee benefits. While challenges arose, the partnership with Take Command effectively navigated them, solidifying AAC's journey towards

a sustainable health benefits administration strategy. The

ensuing sections explore the tangible outcomes and broader

implications of this collaboration for AAC.

Benefits and Challenges of the Take Command Transition

Financial Liberation: Monumental Savings

AAC's partnership with Take Command led to a substantial alleviation of financial pressures. An impressive $460K in savings signified more than just a figure; it represented an opportunity for the company to reallocate funds to other crucial aspects of the business.

The Revolution of Autopay

The AutoPay feature brought about a significant enhancement in the employee experience. Functioning akin to a group plan, it removed the need for employees to initially front the money, making health benefits more straightforward and accessible.

Voices from the Ground: Employee Feedback

The overwhelmingly positive feedback highlighted the successful integration of Take Command's system. Such testimonials underscored both the tangible and intangible benefits that this partnership introduced.

Bridging the Digital Gap: Transitioning the Non-Tech Savvy

Introducing the less tech-savvy demographic to a digital platform was challenging. However, the positive reception of user-friendly features like AutoPay showcased how intuitive and accessible the system had become, even for those initially resistant to change.

Alleviating the Upfront Funding Concerns

The initial concern among new hires was the upfront payment for their insurance. Continuous education and features like AutoPay played pivotal roles in assuaging these concerns, ensuring trust in the new system's reliability and timeliness.

Maintaining Compliance: The Power of Regular Reminders

By instituting a system of regular reminders for quarterly compliance, AAC ensured that its workforce remained aligned with necessary protocols, reflecting the company's commitment to the well-being of its employees.

The Power of Partnership: AAC's Transformative Journey with Take Command

In reflecting on Automobile Acceptance Corporation's journey with Take Command, it's evident that the right partnership can be transformative. From navigating the complexities of employee benefits to harnessing technology for an older workforce, their story is a testament to resilience, adaptability, and the power of collaboration. While challenges were part of the narrative, they were consistently met with innovative solutions that ultimately led to substantial savings and improved employee experiences. AAC's success underscores the potential that lies in embracing change, especially when armed with a partner equipped to guide the way. As more small businesses grapple with similar challenges, AAC's experience serves as both inspiration and a roadmap for the future.

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!