This past year, the number of uninsured Americans rose from 25.6 Million to 27.5 Million, with small business employees making up a considerable fraction of this figure. Whether it's issues with cost or functionality, small group plans can be cumbersome for business owners and a frustrating process to navigate. There's a new resource called Wellthie that's working to reverse this trend, helping small businesses find affordable plans customized to their needs—and we couldn't be more excited about it!

If you are a small business owner considering employee benefits, it is beneficial to know your options. With new health reimbursement arrangements on the market like the Individual Coverage HRA (for companies of all sizes) or the Qualified Small Employer HRA (for companies less than 50), it’s important to understand the pros and cons of this new model of benefits and how it relates to traditional small group plans.

For some, a group plan will make more sense (depending on market conditions and company makeup); for others, a reimbursement solution might be a better fit. And what if you want both? There's a way to do that too.

The key is to understand what the best customized approach is for your company. Take Command Health and Wellthie are here to help.

Is a small group plan the way to go?

When comparing reimbursing for individual plans versus traditional small group plans, remember what’s great for one company might not be great for another. It largely depends on how your company is structured, where your employees live, and your budget.

If prices on the individual market are more expensive than what you’d find in a group plan, the traditional route is the way to go. If there’s limited plan options or narrow provider networks with little competition on the individual market, that’s another indicator that a group plan is probably best.

But how do you find a small group plan that’s right for your business and your budget?

Wellthie is an online national health insurance marketplace featuring thousands of medical and ancillary plans offered by hundreds of carriers. Wellthie is a free and easy tool that will revolutionize your health insurance shopping experience, whether you have never provided health insurance options to your employees before, aren’t sure whether you can afford it, or are dissatisfied with the plan/s in which your employees are currently enrolled.

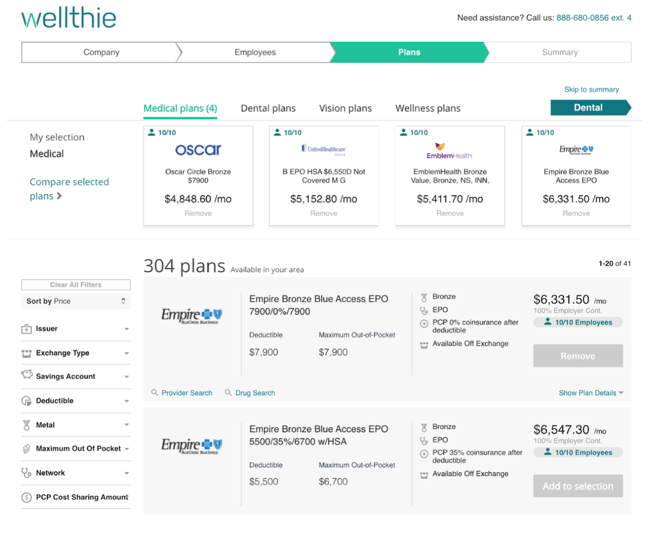

Simply enter your company’s ZIP code, name, and the number of employees, and immediately view and compare your company’s healthcare costs and options.

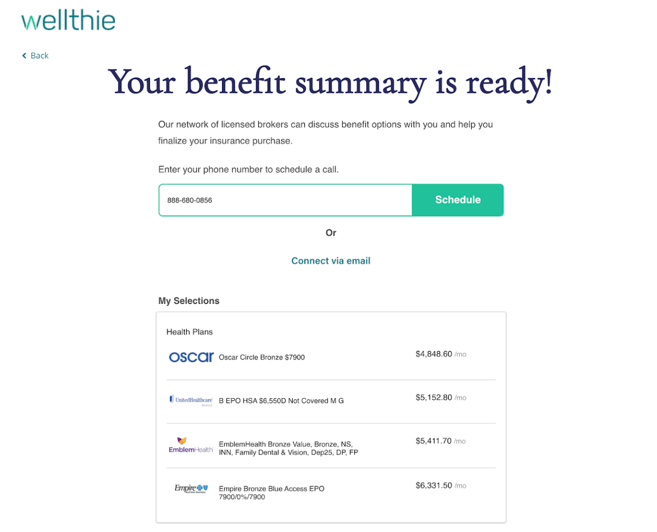

You can filter the plan options available in your area by the carrier, network, metal level, deductible, and more. Select plans to compare and generate accurate, beautifully branded quotes in minutes.

At any stage in the process, seamlessly connect (via chat, email, or phone) to one of the licensed health insurance brokers in Wellthie’s network. These licensed agents will answer any questions you may have and ultimately facilitate enrollment in the plan/s of your choice.

The traditional process for acquiring health insurance for your small business employees is outdated, requiring numerous in-person appointments and tedious paperwork. In order to receive an accurate health insurance quote, you could wait for days, weeks, even months! With Wellthie, you can get reliable quotes in minutes, all formatted in a way you can understand. Discuss your options and get your employees enrolled in your desired plans with the help of a licensed health insurance industry expert at a time convenient for your busy schedule.

Reimburse employees for health expenses with an Individual Coverage HRA

If a group plan isn’t in the cards for your business (or for all of your employees), you might take a look at offering an HRA instead of a small group plan or in conjunction with one.

A few indicators of this would be if group plans are too pricey to be feasible for your company, if you can’t accommodate the group plan increases year over year, if you only want to offer some of your employees benefits, if you’re worried about minimum participation requirements, or you’re just plain stressed over choosing and administering a one-size-fits-all plan for your diverse workforce.

A new tax-friendly HRA—the Individual Coverage HRA (ICHRA) is about to hit the market (Jan. 2020) on the heels of a big push for flexibility and accessibility in the healthcare market that has manifested itself in recent regulatory rule changes.

A result of ongoing healthcare reform efforts spanning two presidencies to alleviate healthcare costs for businesses and return healthy individuals to the market, ICHRA is part of a growing trend in the employer-sponsored healthcare market of switching to a more flexible financial model, much like the shift from pensions to 401ks. While it’s too early to understand the full potential of these new HRAs, the HHS projects that in the next 5 to 10 years, roughly 800,000 employers will offer Individual Coverage HRAs to pay for insurance for more than 11 million employees.

Here’s what to know about ICHRA.

How the new Individual Coverage HRA works

As the name implies, ICHRA is based on reimbursing employees for insurance rather than buying it for them. At a high-level, the way ICHRA works is very simple:

- Employers design their plan, including establishing reimbursement limits and defining which employees are eligible. Employees can be divided by classes (full time, seasonal, part-time, salaried vs. non-salaried, etc. and each class can be extended a different level of benefit—varying reimbursement amounts or even in combination with a group plan.

- Employees purchase the individual plans they want.

- Employees submit claims for reimbursement.

- Employers reimburse employees for valid claims.

Benefits of the ICHRA

Here are a few other arguments in favor of an Individual Coverage HRA benefits solution.

Retain your top talent: The 11 classes and unlimited custom class options allow employers to focus their healthcare spend on the most crucial team members. Want to offer salaried works a group plan and non-salaried workers $300 a month? The ICHRA can make that happen. Want to offer different reimbursement amounts to your seasonal crew than your full-timers? That works too. Want to keep your group plan for existing employees but offer an HRA to anyone new? You can do that as well.

No surprises when it comes to cost: define your benefits budget and stick with it. No annual increases to stress over.

Design the right benefits solution for you: design a plan that fits your team vs. being locked into what an insurance company offers.

Risk de-management: take managing your employees' health risk out of your business plan.

Plan portability: employees own their health plan and can take it with them if they change jobs.

Plan choice and personalization: employees select individual plans that fit their unique needs

No minimum participation concerns: Most group plans require employers to maintain a high participation rate—typically around 70%. This can force employers to offer more generous and expensive benefits than they may have otherwise in order to keep the plan intact.

Need help navigating?

If you want to learn if HRAs like ICHRA are the best option for your business, reach out to our team at Take Command Health. We can help you design your ICHRA to include classes for full time employees that will receive a traditional small group plan. We even have our own private exchange for employees to shop for the individual plans of their choice.

If you're looking for an affordable and customized group plan to offer with your ICHRA or as part of your overall benefits solution, Wellthie is an excellent resource for you.

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!